By Walter Sorochan Emeritus Professor: San Diego State University

Posted April 10, 2012; Updated July 5, 2015. Disclaimer The information presented here is for informative and educational purposes only and is not intended as curative or prescriptive advice.

The Problem:

The USA government is spending more money than it collects as revenue. The country spends more than it gets as income. Congress talks about reducing subsidies and entitlement programs as a way to balance the budget. What are these programs? Thomas Jefferson and Alexis de Tocqueville perceived that the enlightened citizenry of American would make good decisions if they were armed with the right information.This article attempts to put Jefferson's idea into practice by defining subsidies and entitlement programs; and describing overspending and ways to balance a "healthy" budget.

There are five programs that have been identified as major contributors to overspending: entitlements, subsidies, pork-barrels, war defense spending and empire building.

What is really causing overspending and what can we do about it? Back to top

A word of caution about interpreting government financial budgets:

The federal government follows arcane accounting practices that are very different from private business or corporate accounting. Federal government does not distinguish capital budget or long term investment from operating budget [ as for day-to-day operations ].

As a result, when funding is limited, government may choose to reduce investments for the future to preserve resources for day-to-day operations. Budget "scoring" rules give Congress incentives to hide the true costs and thereby help Congressional committees defend their turf!" Meeker: Guide to debt crisis In a nutshell, there is a lot of "hanky-panky" going on in our government.

Meeker Badkar: Guide US spending, in her analysis of the federal budget and debt crisis, used a corporate accounting model and related her analysis to the actual federal accounting system. Below are her comments about comparing the real US budget crisis with a similar private corporate entity:Badkar: Guide US spending

Meeker's approach allowed her to be neutral and unbiased.

Meeker's conclusion is that America is spending beyond its means. This has caused a problem of mounting losses and increasing debt. Back to top

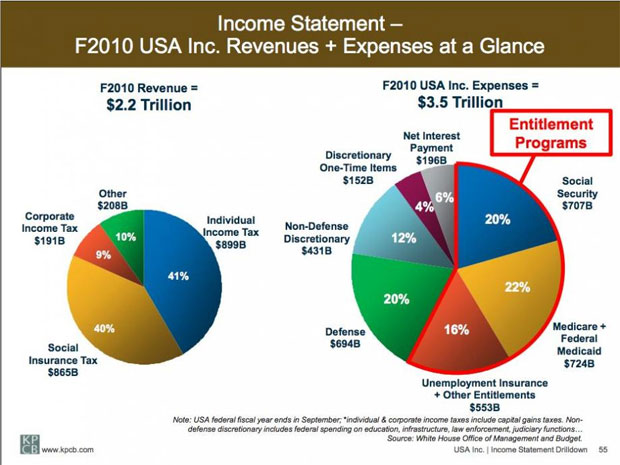

Look at Meeker's analysis of the 2010 budget:

This Graphic is the most resent "income statement" of the United States in 2010. "Revenue" is symbolized as a small circle is on the left. "Expenses" are on the right drawn by a larger circle. As horrifying as these charts are, they don't even show the trends of these two pies: The "expense" pie [ on right side ] is growing like gangbusters, driven by the explosive growth of the entitlement programs that no one in government even has the courage to talk about. "Revenue" is barely growing at all. Blodget: income-spending 2010 The illustration above looks impressive until you disect the pieces of the pie and try to pin-point the specific aspects of defense spending. That is what this article tries to do. The specifics are hidden and not even the president has all the details. The same is probably true for the other pieces of the budget. Without all the specifics of the budget, it is very difficult to balance the budget.

Only the first four programs are included in government discussions about overspending. Back to top

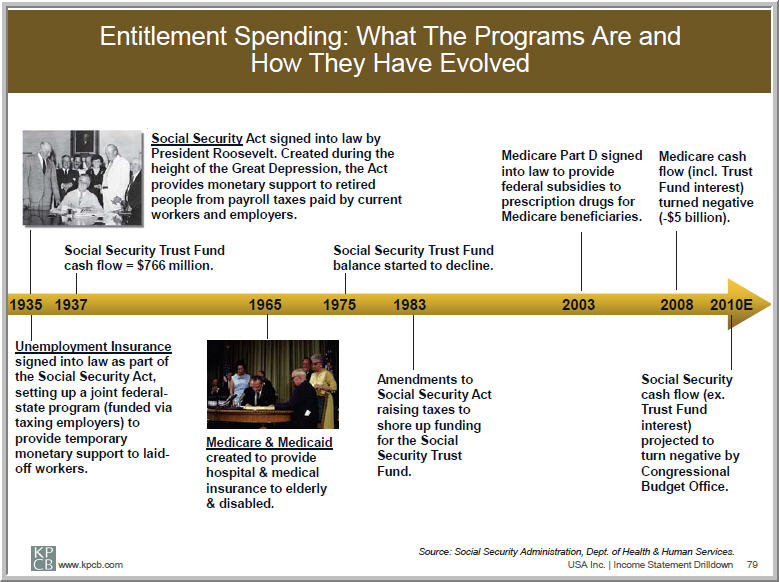

Entitlement programs:

have been singled out by politicians as the biggest reason for our federal money problems! So .... what are entitlements?Entitlements: Entitlements are government programs that requires payment to anyone who meets specific qualifications; those who qualify are thus “entitled” to the payments; such as Social Security, Medicare, unemployment insurance, food stamps, etc.. These are "entitlement programs." Political terms: Entitlements

Entitlements are legislatively passed as laws in healthcare and social security to provide financial help to unknown numbers of persons in the future. "It is often very hard to predict in advance just how many individuals will meet the various entitlement criteria during any given year. Inability to predict number of future persons makes it difficult to predict what the total costs to the government will be at the time the appropriation bills for the coming fiscal year are being drafted." Political terms: Entitlements

Entitlements are legislatively passed as laws in healthcare and social security to provide financial help to unknown numbers of persons in the future. "It is often very hard to predict in advance just how many individuals will meet the various entitlement criteria during any given year. Inability to predict number of future persons makes it difficult to predict what the total costs to the government will be at the time the appropriation bills for the coming fiscal year are being drafted." Political terms: Entitlements

In such instances, as when dealing in the unknown number of persons needing future health care, the congress passes entitlement "health care" laws. A medicaid law is often passed that is open-ended in the amount of spending or the amount of spending will be a huge amount bigger than initially needed. This makes it easier for congress to plan and then allocate funds over time. Such provisions usually stipulate that all the monies allocated need to be spent after a specified period of time; unspent money is revoked. Hence, such legislation contributes to uncontrolled overspending as the allocated funds are always spent; often foolishly. Since the middle 1980s, entitlement programs have accounted for more than half of all federal spending. Political terms: Entitlements Back to top

Subsidies:

Entitlements may also be related to subsidies and pork barrels! Subsidies are ways of distributing government financial help to certain groups of persons.An example of a subsidy would be the government paying farmers a little extra for their wheat when the farmers need to sell their wheat below the cost of production, for less in the international market, in order to be competitive. This type of subsidy is the "little help" given to a special group of wheat farmers so they can stay in business to provide a much needed product.

Subsidizing the cost of raising wheat, for example, allows farmers to be competitive with farmers from other countries. Subsidies are typically advocated either to promote more widespread consumption of some goods or service deemed to be especially essential or meritorious by the government ("merit goods"), to boost the levels of production of goods whose manufacture or consumption involves sizable "positive externalities" or partake of the nature of "public goods," or sometimes simply to stave off bankruptcy and unemployment in a declining industry or segment of an industry whose owners and/or workers enjoy a lot of political influence." Political terms: Entitlements

A subsidy is money the Government gives to companies or individuals who make, billions of dollars in profits yearly, with no taxes paid on profits or subsidies. By contrast, an entitlement is like social security that the average person gets. We have to work for years to pay into the social security fund. During the time while all our money is building up as for our Social Security, the Government is borrowing it and it becomes part of the deficit like it is now. Back to top

Types of subsidies: Wiki: Subsidies

Subsidies can be complicated, non-transparent and difficult to understand. There are many different ways to classify subsidies, such as the reason behind them, the recipients of the subsidy and the source of the funds (government, consumer, general tax revenues, etc.). In economics, one of the primary ways to classify subsidies is the means of distributing the subsidy. Subsidies do not always provide an equal playing field. All this uncertainty is further muddled up by lack of real transparency in government circles! So .... lets start with a few real examples:

USDA Agriculture Subsidies:

Despite the rhetoric of "preserving the family farm," the vast majority of farmers do not benefit from federal farm subsidy programs. The U.S. Department of Agriculture classifies all farm subsidies — even guaranteed farm loans — as “financial assistance.” None of the programs are means-tested, and Environmental Working Group [ EWG ] research has found that from 1995-2009, the largest and richest 10 percent of recipients got 74 percent of all subsidies.

The federal government provides a "safety net" to agricultural producers to help them through the variations in agricultural production and profitability from year to year - due to variations in weather, market prices, and other factors - while ensuring a stable food supply. More than 90 percent of agriculture subsidies go to farmers of five crops—wheat, corn, soybeans, rice, and cotton. A handful of other commodities also qualify for government support, including peanuts, sorghum, and mohair, though subsidies for these products are far smaller. More than 800,000 farmers and landowners receive subsidies, but the payments are heavily tilted toward the largest producers. Edwards: Aggie subies The U.S. Federal government spends less than 1% of its agriculture subsidy budget on fruits and vegetables. Dairy and sugar producers have separate price and market controls that are highly regulated and can be costly to the government. FSD: farm subsidies 2011

A 'catch 22' in agricultural subsidies: The U.S. government has been directly funding the research and development of Monsanto GMO genetically modified agricultural products. Monsanto developed a special modified corn that is good for synthesizing corn syrup and alcohol but not good as food. O'Neall: Monsanto danger 2011

Corn syrup as a sweetener is potentially bad for our health and economy. Government handouts to corn farmers have driven down the price of corn so far that sugar has been essentially replaced as the means of sweetening our food. Instead, we use high fructose corn syrup, a substance that is much harder for our bodies to break down and that is reputed to be addictive. The result is that the corn syrup in the soda we drink more soda today, making us fatter and more prone to diseases like diabetes than the same soda made with real sugar. The same goes for any product [ pastry ] where “high fructose corn syrup” appears in the list of ingredients. If it weren’t for corn subsidies keeping the price of corn artificially low, a purer and safer form of sugar could be used in our foods. Silva: Corn subs bad Back to top

Sugar Subsidies: The 2008 farm bill added a new sugar-to-ethanol program under which the government buys excess imported sugar that might put downward pressure on inflated domestic sugar prices. The program defends domestic sugar growers’ 85 percent of the U.S. sugar market, and it allows for the government to sell excess sugar, at a loss if need be, to ethanol producers. Edwards: Aggie subies Back to top

Dairy and beef subsidies: were $261.9 billion in subsidies 1995-2010. FSD: farm subsidies 2011

Program Subsidies: # Recipients 1995-2010 Subsidy Total 1995-2010 Livestock 30,308 $227,269,580 Dairy Programs 51,490 $74,142,754 Meat and Dairy received a whopping 63% of the subsidies doled out by Uncle Sam in 2010 while Grains and Sugar raked in 20% and 15% respectively. Bradley: aggie subsidies 2011

Infrastructures: like repairing power grids, water treatment plants, bridges and highways. Back to top

Labor subsidies: A labor subsidy is any form of subsidy where the recipients receive subsidies to pay for labor costs. Examples may include labor subsidies for workers in certain industries, such as the film and/or television industries.

Oil Company subsidies: Oil subsidies were initially started about 1920 as incentives to help oil companies explore and develop oil fields. In 2011 the three largest U.S. oil companies made a combined profit of more than $80 billion. Fossil fuels get more than $70 billion in federal subsidies, but the US provides only $12 billion for clean energy. Curren: Fossil subsidies

The top five multi-national oil companies made over $900 billion in profits over the last decade [ 2000 - 2010 ] – with another $36 billion in profits just in the 2011 quarter. Pelosi: Price relief act 2011 Do oil companies really need subsidies today? Back to top

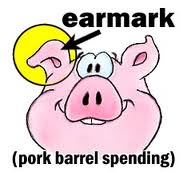

Pork Barrel Spending:

Pork barrel is the appropriation of government spending for localized projects secured solely or primarily to bring money to a representative's district. Typically, "pork" involves funding for government programs whose economic or service benefits are concentrated in a particular area but whose costs are spread among all taxpayers. Public works projects, certain national defense spending projects, and agricultural subsidies are the most commonly cited examples. Wiki: pork barrel

Pork barrel is the appropriation of government spending for localized projects secured solely or primarily to bring money to a representative's district. Typically, "pork" involves funding for government programs whose economic or service benefits are concentrated in a particular area but whose costs are spread among all taxpayers. Public works projects, certain national defense spending projects, and agricultural subsidies are the most commonly cited examples. Wiki: pork barrel

Since its establishment in the late 1700s, the legislative branch of the United States has seen its fair share of corrupt politicians and congressional scandals. Most of these forms of corruption – bribery, nepotism, electoral fraud, and embezzlement, to name a few – have been dealt with harshly and have since been made illegal. One political weapon, however, that still remains legal and is used today more than ever before is pork barrel spending. According to the Citizens Against Government Waste (CAGW), in their publication titled "2009 Congressional Pig Book Summary," "A „pork‟ project is a separate line-item [ a document, record, or statement ] in an appropriations bill that designates tax dollars for a specific purpose in circumvention of established budgetary procedures". This pork barrel spending is usually made by members of Congress who agree to vote for the passage of a bill only after he or she is permitted to add his or her own "pork or excess fat" to the bill. With the recent passage of several record-breaking bills, such as President Barack Obama‟s $787 billion stimulus bill and the $700 billion bank bailout, both of which were laden with "pork," pork barrel spending has become a topic of controversy in American politics today.

While some may argue that pork barrel spending is a necessary tool for politicians to deliver benefits to his or her constituents, many would agree that the spending is much more detrimental than beneficial. Walker argues that pork barrel spending and the addition of pork barrel projects to legislative spending bills are unethical for the following reasons: pork barrel spending wastes billions of American taxpayer dollars each year, the specific pork barrel projects are often trivial and unnecessary, and pork barrel spending provides unfair advantages to incumbent politicians in elections. Walker: ethics of pork barrels Back to top

Earmarks:

Earmarks, or pork-barrel projects, are added to the federal budget by members of the appropriation committees of United States Congress. For example, if the proposed cost for fixing a broken bridge is $50 million but the amount spent is only $40 million, then a congressional member tries to spend the extra $10 million by attaching some irrelevant project as an earmark that will use up the $10 million.

Earmarks, or pork-barrel projects, are added to the federal budget by members of the appropriation committees of United States Congress. For example, if the proposed cost for fixing a broken bridge is $50 million but the amount spent is only $40 million, then a congressional member tries to spend the extra $10 million by attaching some irrelevant project as an earmark that will use up the $10 million.

Earmarks themselves are not about increasing the budget or monies that get spent. They are about HOW that money gets divided up and spent. That is where the big mistake concerning earmarks reside. Congress regularly budgets the money. They ALWAYS overestimate the budgets for the appropriation of funds. Then they divide the funds up and use them all. They make no attempt to “save” anything.

Classic examples of such pork-barrel legislation include Federal appropriations bills for dams, river and harbor improvements, bridge and highway construction, and job-training centers, as well as legislation designed to prevent closure of obsolete or unneeded military installations, prisons, VA hospitals and the like.

During the 2008 U.S. presidential campaign, the Gravina Island Bridge (also known as the "Bridge to Nowhere") in Alaska was cited as an example of pork barrel spending. The bridge, pushed for by Republican Senator Ted Stevens, was projected to cost $398 million and would connect the island's 50 residents and the Ketchikan International Airport to Revillagigedo Island and Ketchikan. Back to top

War Defense Spending:

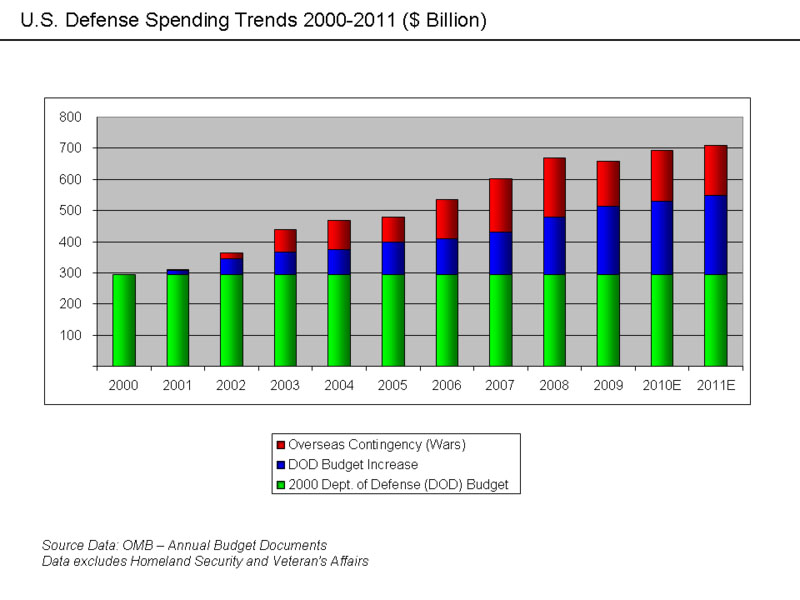

War spending is considered to be different from subsidies and entitlement programs. Wars are usually funded by congress and categorized as defense budget. But politicians play games with words to make themselves look good or innocent. And so finding the real total amount spend on the recent wars in Iraq and Afghanistan is confusing and difficult to understand.The initial graph on the US spending identified the Defense Spending as 20 % of the US budget for 2010. The cumulative cost of the two wars for 2010 was: $ 685 billion =war in Iraq; $ 231 billion = war in Afghanistan; $ 34 billion = other related operations. Blodget: income-spending 2010 This information is not transparent nor complete. Defense spending is at its highest level since WW II. Defense spending is the second-largest expense item after entitements. Meeker: Guide to debt crisis Blodget: income-spending 2010

The recent invasions of Iraq and Afghanistan were largely funded through supplementary spending bills outside the Federal Budget, so they are not included in the military budget figures listed below. Starting in the fiscal year 2010 budget however, the wars in Iraq and Afghanistan are categorized as "Overseas Contingency Operations" and included in the budget. By the end of 2008, the U.S. had spent approximately $900 billion in direct costs on the Iraq and Afghanistan Wars. Indirect costs such as interest on the additional debt and incremental costs of caring for the more than 33,000 wounded borne by the Veterans Administration are additional. These figures do not include war contractor civilian costs like Halburton. Wiki: US Military budget

Empire Building Costs:

There are 272 US embassies in the world. There are at least 725 American military bases in existence outside the United States. The American Empire Project However, nobody can say for sure precisely how much the United States spends on defense, and nobody can say for sure how many bases the U.S. government has abroad. Eddlem: cutting defense 2011 Winn: cost of empire 2010 Vance: military bases-embassies 2004

It's time to ask whether the nation can really afford some 1,000 military bases overseas. For those unfamiliar with the issue, you read that number correctly. One thousand. One thousand U.S. military bases outside the 50 states and Washington, DC, representing the largest collection of bases in world history. The map below illustrates the empire in shades of "red!"

Source: Martin: Map US empire 2012 Vance: military bases-embassies 2004

Officially the Pentagon counts 865 base sites, but this notoriously unreliable number omits all our bases in Iraq (likely over 100) and Afghanistan (80 and counting), among many other well-known and secretive bases. More than half a century after World War II and the Korean War, we still have 268 bases in Germany, 124 in Japan, and 87 in South Korea. Others are scattered around the globe in places like Aruba and Australia, Bulgaria and Bahrain, Colombia and Greece, Djibouti, Egypt, Kuwait, Qatar, Romania, Singapore, and of course, Guantánamo Bay, Cuba -- just to name a few. Among the installations considered critical to our national security are a ski center in the Bavarian Alps, resorts in Seoul and Tokyo, and 234 golf courses the Pentagon runs worldwide. Winn: cost of empire 2010 Vine: costs overseas bases 2009 Vance: military bases-embassies 2004 Back to top

Fixing the budget:

The major problem is lack of transparency in government with entitlement programs and empire building. It is impossible to fix a problem when information is hidden from public view.

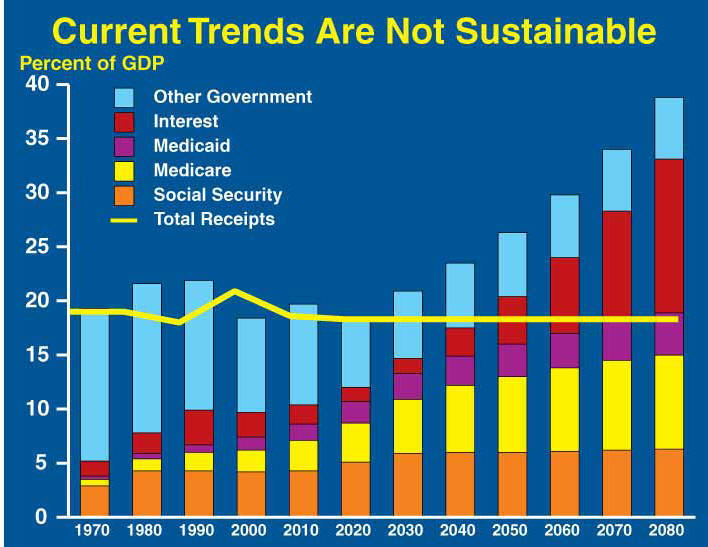

According to Mary Meeker, social security and unemployment insurance have worked fairly well at near break-even; as these have been funded from a relatively large working class. The snag is with medicaid and medicare .... these have been poorly financed. Both health programs have been built on top of a very bad health care system. So trying to fix medicare and medicaid is often done as a band-aid or short-term fix that doesn't really work. All this mess is further complicated by the semantics of the words used to describe financing procedures.

Interpretation of above graph --- Current Trends Are Not Sustainable : The above graph is a stacked bar chart titled, Current Trends Are Not Sustainable, showing Government spending, expressed as a percent of GDP, in ten-year intervals for 1970 to 2080. The chart also shows Government receipts, expressed as a percent of GDP, as a yellow line from 1970 to 2080. The vertical scale on the left side of the chart goes from zero to 40 percent of GDP. The data for 1970 through 2000 reflect actual spending and receipts. The data for 2010 through 2080 reflect projections. Spending is shown as stacked bars with Social Security on the bottom, Medicare stacked on top of Social Security, Medicaid on top of Medicare, Interest on top of Medicaid and Other Government on the very top. The chart shows that between 1970 and 2020, Government receipts are generally equal to total Government spending. The chart also shows that over the long term, Social Security is projected to increase slightly, Medicare and Medicaid are projected to increase quite significantly, and interest is projected to increase dramatically. Interest is projected to grow dramatically because the chart assumes that Government receipts will remain at their 40-year historical level of 18.3 percent of GDP while total Government spending, especially Medicare and Medicaid, continue to grow. Increases in spending with receipts held constant, as a percent of GDP, will require the Government to borrow more money from the public, which leads to increases in interest. The chart shows that by 2030, Government spending will exceed historical levels of receipts and lead to ever increasing amounts of borrowing. The chart also shows that if receipts remain at their historical level of 18.3 percent of GDP, by 2070, receipts will be sufficient to cover the costs of only Social Security, Medicare and Medicaid." Projected Entitlement programs Feb. 4, 2008 By the way, we are spending all this as borrowed money that we do not have. Back to top

Saving Money:

"To get the earmarks argument to actually save money, one would have to get Congress to change the way they build their budget. They would need to get Congress to ONLY budget the money necessary to accomplish a certain task. For instance, if the military costs are $20 billion for the year, they should ONLY budget $20 billion instead of $30 billion. They would not be able to add on $10 billion in ear marks to use up the extra money they budgeted. By rearranging the way the budgets are created Congress can then eliminate earmarks and actually save money." Kearney: Cutting earmarks

"To get the earmarks argument to actually save money, one would have to get Congress to change the way they build their budget. They would need to get Congress to ONLY budget the money necessary to accomplish a certain task. For instance, if the military costs are $20 billion for the year, they should ONLY budget $20 billion instead of $30 billion. They would not be able to add on $10 billion in ear marks to use up the extra money they budgeted. By rearranging the way the budgets are created Congress can then eliminate earmarks and actually save money." Kearney: Cutting earmarks

The problem with this fix is that congress persons are under the spell of lobbyists who harpoon congress persons to do their bidding in exchange for campaign re-election funding. We would also need to change lobbying and campaign legislation! Moyers: David Stockman on democracy

Fixing bad political practices is essential but difficult. Classic example is the new data that clearly show that little has changed in America’s misguided and broken farm subsidy programs. Politicians were unable to pass legislation to cut back agricultural subsidies in 2011. Sciammacco: farm subs 2011 The federal government continues making farm subsidies worse by its silent "make people sick policy" . Federal subsidies for certain kinds of food like genetically modified corn will directly influence the production and subsequent consumption of that food. The US food subsidies are grossly skewed, creating a diet excessively high in factory-farmed meats, grains and sugars, with very little fresh fruits and vegetables or healthy fats from nuts and seeds. Mercola: Govt makes you fat A recent March 9, 2010 New York Times article states, “Thanks to lobbying, Congress chooses to subsidize foods that we’re supposed to eat less of.”

Another quote from President Reagan's former budget director David Stockman: "The Obama administration’s $78 billion cut to US defense spending is a mere “pin-prick” to a behemoth military-industrial complex that must drastically shrink for the good of the republic" Diebenow: David Stockman on budget 2011

According to former defense secretary Rumsfeld's estimates in 2004, we could save at least $12 billion by closing 200 to 300 bases alone. But this proposal to closure the bases was derailed. Vine: costs overseas bases 2009

The hidden and secret costs of maintaining an empire make it difficult to reign in the expenses. Yet this is what an honest government must do!

And finally a word about fixing the health care programs. The health care system has been band-aided since 1910. It was a house built with no-plan on a weak foundation. We should start from scratch and build a health care system on a supportable foundation with incentives for a preventable future. Bilding a new health care system would include legislation that endorses healthy food subsidies and promotes optimal well-being. Back to top

The author appreciates your feedback: E-mail

References:

Blodget Henry, "Here's The Only Chart You Need To See To Understand Why The US Is Screwed," Business Insider, February 28, 2011. Blodget: income-spending 2010

Badkar Mamta, "Mary Meeker's Definitive Guide To The American Public Debt Crisis," Business Insider, February 25, 2011. Badkar: Guide US spending

Bradley Bruce, "What’s Wrong With This Picture?" Bradley Blog, June 9, 2011. Bradley: aggie subsidies 2011

Curren Erik, "A real chance to cut subsidies to Big Oil?" Energy Bulletin, February 16, 2011. Curren: Fossil subsidies

Diebenow Nathan, "Exclusive: America has ‘reached the point of no return,’ Reagan budget director warns," The Raw Story, January 10, 2011. Diebenow: David Stockman on budget 2011

Eddlem Thomas R., "Can We Cut "Defense" Spending?" New American, March 08, 2011. Eddlem: cutting defense 2011

"U.S. “defense” spending today has all of the hallmarks of every other out-of-control big-government program. For example, nobody can say for sure precisely how much the United States spends on defense, and nobody can say for sure how many bases the U.S. government has abroad. Investigative reporter Nick Turse searched official government reports and found that different agencies disagreed with each other over the number. “According to the Department of Defense’s 2010 Base Structure Report, the U.S. military now maintains 662 foreign sites in 38 countries around the world,” Turse wrote for CBSNews.com on January 10. “Dig into that report more deeply, though, and Grand Canyon-sized gaps begin to emerge.” For example, the official roster lists no bases in Kuwait, Saudi Arabia, and Qatar, nations that the United States uses as staging areas for its wars in Iraq and Afghanistan. Ditto for Afghanistan, even though it’s known we have more than 400 bases there to wage our war in that troubled nation. Turse eventually concluded that determining the number of U.S. military bases abroad was impossible: “[In] a world where all information is available at the click of a mouse, there’s one number no American knows. Not the president. Not the Pentagon. Not the experts. No one.”"

Edwards Chris, "Agricultural Subsidies," CATO Institute, June 2009. Edwards: Aggie subies

Entitlement is a guarantee of access to benefits based on established rights or by legislation. Wiki: entitlement "Entitlements" usually means Social Security, Medicare, & Medicaid payments, plus any other programs which are promised to people over many years.

Farm Subsidy database, 2011. FSD: farm subsidies 2011

Glossary of Political Economy Terms Political terms: Entitlements

Kearney Jim, "Cutting Earmarks Do Not Save Money," Libertarian Viewpoint, November 19th, 2010. Kearney: Cutting earmarks

Martin Ben, "US Global Empire," Portland Tactical-PDXTAC.com, January 7th, 2012. Martin: Map US empire 2012

"Mary Meeker's Definitive Guide To The American Public Debt Crisis," Meeker: Guide to debt crisis Meeker interprets the USA budget and government as though it were functioning as an independent corporate enterprise. She attempts to present her version of how the budget would be viewed from a private business entity and not a government bureaucracy.

Mercola, "OBESITY CONSPIRACY: The U.S. Government Scandal that's Really Making You Fat," Mercola.com, May 04 2010. Mercola: Govt makes you fat

Moyers Bill, "David Stockman on Crony Capitalism," Bill Moyers and Company, March 9, 2012. Moyers: David Stockman on democracy Stockman writing book: The Triumph of Crony Capitalism. DAVID STOCKMAN: "Crony capitalism is about the aggressive and proactive use of political resources, lobbying, campaign contributions, influence-peddling of one type or another to gain something from the governmental process that wouldn't otherwise be achievable in the market. And as the time has progressed over the last two or three decades, we have crony capitalism! It's not a free market."

O'Neall Siv, "Monsanto and the Mortal Danger to Traditional Agriculture," OpenEdNews, August 21, 2011. O'Neall: Monsanto danger 2011

Organic Consumers Association, "Massive US Government Subsidies for GE Soybeans," Organic Consumers Association: Soyabean subsidies"The US government has created an artificial domestic and international market for US soy, the world's largest source of genetically modified food and animal feed."

Pelosi Nancy, "Taxpayer and Gas Price Relief Act," Democratic leader Nancy pelosi, May 05, 2011. Pelosi: Price relief act 2011

Physicians Committee for Responsible Medicine, "Health vs. Pork: Congress Debates the Farm Bill," PCRM. PCRM: Pork bill debate 2007 Kuban: subsidized food 2007

Sciammacco Sara, "Despite Claims of Reform, Subsidy Band Marches On: Non-farmers, Urbanites Still Receiving Farm Subsidies," Environmental Working group, June 23, 2011. Sciammacco: farm subs 2011

Silva Pedro R., "Corn Subsidies Make Me Sick (and Fat)," Student Pulse [ Student online Journal ], 2010, Vol. 2 No. 11 Silva: Corn subs bad;

"The neat Trick," ThePoopDeck, Neat Trick: Discretionary spending 2010

US Fed Assistance programs, "List of US Federal Government Funding Programs," US Fed Assist programs

Vance Lawrence M., "Martin: Map US empire 2012," LewRockwell.com, March 16, 2004. Vance: military bases-embassies 2004

Vine David , "The Costs of Empire: Can We Really Afford 1,000 Overseas Bases?" AlterNet: World, March 10, 2009. Vine: costs overseas bases 2009

Walker Patrick J., "Pork Barrel Spending: Is It Unethical?" Gatton Student Research Publication. Volume 2, Number 2.Gatton College of Business & Economics, University of Kentucky, Copyright 2010. Walker: ethics of pork barrels

Wikipedia, "Genetically modified food." Wiki: GMO

Wikipedia, "Military budget of the United States." Wiki: US Military budget

Wikipedia, "Pork Barrel." Wiki: pork barrel

Wikipedia, "Subsidy." Wiki: Subsidies

Winn Patrick, "The cost of an empire," GlobalPost, October 4, 2010.

Winn: cost of empire 2010 Five expensive, controversial US military bases (that aren’t in Iraq or Afghanistan). Back to top