By Walter Sorochan, Emeritus Professor San Diego State University

Posted May 03, 2008; updated January 31, 2022..

Update 2019: The information in this article on Swaps [CDS] is still correct, but many of the numerous backup references are no longer available. These references or connective links are broken and the original authorship has been erased. This does not deminish the information, for the information was correct 11 years ago. The original author source of the link has been broken. This author has left the information intact, without backup reference to the authorship, as the information does help to explain how credit default swaps began, how it was used to create credit without backup collateral and how this swaping sale of credit junk bonds lured eager investors to buy unsecured notes in hopes of making money. This included mostly rich banks and even national governments, many of whom went broke. As of today, 2019, those holding CDS are still stuck with somewhat worthless money credit notes that could help bring the world economy down. A CDS is not cash, it is paper debt of baskets of house and auto credit finances. Ofcourse, the banks and swapers will deny all of this!

| I could not fully understand the banking crisis of Bear Stearns Bank! And the Enron scandal likewise was confusing. The words that were used and the even the procedures used to trade and buy bank notes? Was I stupid ? Was banking magic? Well, I decided to really study all this fancy bank stuff. After several months of intensified reading I finally simplified banking jargon. I hope that this article helps you to better understand what CDS is and how it works. Walter Sorochan |

The economic mess the entire world found itself in 2008 started a long time ago; probably 300 years ago. But it started surfacing in 2001 when banks began using a special way of providing collateral [ real property or money security ] for money they were borrowing from investment banks and others. Enron, the energy giant in 2000, exploited special credit notes, called Credit Default Swap, to create a paper money empire that collapsed in 2002. Indeed, the usual way of getting a loan or mortgage from a loaning institution was to provide solid collateral in exchange for the loan. The loaning institution would give the loan while the borrower [ home owner ] gave the house as collateral. There was a simple swap or trade. The house was an insurance for the loaning institution in case the borrower could not make the payments and goes into default. Upon default, the loan institution kept the house by virtue of the loan paper [trust deed ] or until the loan was paid up and then gave the trust deed back to the owner of the house.

But this simple “ bank – homeowner ” transaction changed with the big banks.

Big investment and commercial big banks, as holders of the house loan [ paper debt ] could, in turn, resell or swap again to still another party, and so on. Swapping at this high level was not for a single house but instead, for multi-million dollar basket of homes “ paper note “ equities that very often could be worthless in the long run. The swapping was a scam form of “ pass the buck for payment and hope you don’t get caught with having to pay up!

Big investment and commercial big banks, as holders of the house loan [ paper debt ] could, in turn, resell or swap again to still another party, and so on. Swapping at this high level was not for a single house but instead, for multi-million dollar basket of homes “ paper note “ equities that very often could be worthless in the long run. The swapping was a scam form of “ pass the buck for payment and hope you don’t get caught with having to pay up!

Banks evolved the swapping of collateral a step further 20 years ago [1988]. Instead of holding the collateral home as security until the owner paid the loan off, the new instrument for the loan allowed banks to sell or “ swap ‘ their collateral [ home ] to another company in exchange for paper equity. The new instrument was called the Credit Default Swap [ CDS ] and it was used by big loan and commercial banks as a way of securing loans. The CDS became an insurance policy against the loan failing. Credit default swaps [ CDS ] were designed as “insurance” to reimburse banks and bondholders when owner of the paper debt failed to pay their debt(s). Since, 2000, Banks dangled CDS, like a carrot to catch a rabbit, to attract buyers when they had a hard time raising cash. Big banks used CDS as a way to raise cash and thereby have more cash to loan out. Banks need cash liquidity and CDS became a way of generating this cash!

What is a Credit Default Swap or CDS? [ 30 ] Credit default swaps are insurance policies against defaults, but there is no requirement to actually hold any asset or suffer any loss, so CDS are widely used just to speculate on market changes. [ 35. Brown ] Credit-default swaps [ CDS ] can be used in a number of ways. CDSs provide an insurance against default to big banks. A CDS is a way of buying insurance on bonds or debt without calling it insurance because, well, only insurance companies are allowed to sell insurance. Credit default swaps are bought by bond holders to hedge or bet against the default risk of banks.

A Credit Default Swap is a credit derivative or agreement between two counterparties, in which one makes periodic payments to the other and gets promise of a payoff if a third party defaults. The first party gets credit protection, a kind of insurance, and is called the "buyer." The second party gives credit protection and is called the "seller," The third party, the one that might go bankrupt or default, is known as the "reference entity." [ William Engdahl," CREDIT DEFAULT SWAPS THE NEXT CRISIS," Financial Sense Editorials, 2008, website ]

The Credit Default Swap is an insurance or hedge against possible default by the bank that creates the CDS. CDSs are also used to speculate [ gamble ] on the ability of companies or governments to repay their debt and offer a benchmark for pricing securities. Such a benchmark, the CDS index, is used to calculate a bank' s solvency. A low CDS value indicates good credit quality and liquidity while a high CDS value indicates the opposite. This is a well kept secret and no one on TV seems to understand it, much less talk about it. [1. Newman ] [ 2. International Swaps and Derivatives Association, Inc. ] [3. Wikipedia ]

How does this contract work? Lets look at how CDS protects the bank issuing the contract. The bank creates a contract to buy insurance against it going broke or default on borrowing money. An insurance company or entity agrees to buy the bank contract on the assumption that it can make money by selling it to another party for a profit. Such purchase becomes a source of income to the bank. In return for the insurance coverage, the bank pays a “ premium “ amount, usually 10 % of the CDS value. [ 36. Pearlstein: good explaination of CDS ]

The buyer of the insurance makes periodic payments to the seller [ a bank ] and in return obtains the right to sell a bond issued by the reference entity for its face value if a credit event [ like a default ] occurs. The rate of payments made per year by the buyer is known as the CDS spread.

[4. Morgensen ]

[4. Morgensen ]

Suppose that the CDS spread for a five-year contract on Ford Motor Credit with a principal of $10 million is 300 basis points [bp ]. This means that the buyer pays $300,000 per year and obtains the right to sell bonds with a face value of $10 million issued by Ford for the face value in the event of a default by Ford. This scheme works as long as the originator of the CDS [ Ford in the above example ] does not have a major run [ to pay cash ] on this debt. If Ford does not have enough cash on hand to cover its run on money by creditors, then Ford declares bankruptcy and fails.

By issuing CDS as a contract and allowing the buyer to take the risk of the CDS, the bank usually has more cash on hand to make more loans. This scheme worked as long as the originator of the CDS did not have a major run on this debt and the bank can keep getting more persons to take out a loan and pay premiums.

Anyway, big commercial and investment banks are unregulated, and the insurance companies had found a loophole in the law that allowed them to deal with these CDS that derived value from insuring risk of debt. They set up shell companies called ‘transformers’ that they used as off-balance-sheet operations where they sold CDSs in which one party assumes the risk of a bond or loan going bad for a fee. The transformers are now in trouble. Their CDS paper notes outstanding today [ 2008 ] are notionally [current street value ] valued at $47 trillion and monolines [ poorly regulated insurance companies ] or small banks, have an asset base of around $2 trillion. [ 5. Roy ]

How worthy is the CDS contract? Things got totally insane when the credit markets allowed interest on bonds to be paid not with cash but with issuance of still more paper debt. Debt was paid back with more debt with discounts at each transaction! Thus, the real liquidity value of a big bank selling a CDS and using it as accounting for cash becomes questionable and suspect. A CDS is not cash, it is a paper of debt contract. [6. Shedlock, Mish ]

The original CDS is usually discounted from 3 to 10 or more percent. As the CDS note is bought by transformers [ second buyer, this buyer to a third and so on ] down the line, there is usually a discount in the value of the CDS note.

The value of each transactional sale may be discounted or increased in value, without previous holder’s knowledge.

Since the value of a CDS is not standardized, there are usually differences in the real value of a CDS contract from buyer to buyer.

The bad swap deal occurs when the company buying the contract has a lot of bond debt, say from a small Spanish bank with a ton of real-estate loans, or with a shrinking capital base. When the Spanish bank does not have enough cash on hand to cover a run on its debt, then it either immediately seeks an immediate loan or declares bankruptcy. Everyone in the circle of swaps, including the originator of the CDS, is affected and could end up losing their swap equity and liquidity.

The worthiness and true value of a CDS is further muddied by hidden and irregular book-keeping, referred to as off-balance-sheet operations. The CDS is not recorded nor reported in the required accounting of a bank. In case of a default, as in Bears Stearn default, the real value of the CDS is difficult to trace and may be unknown. The value of the CDS is further complicated by this hidden chain of CDS reselling, when the originator of the CDS, the bank, is not notified of subsequent transactions. Why would a speculator buy CDS? Answer: to make money.

Getting the Real value of a CDS:

Another way to gauge the risk of your bank account is to look at the credit default swap market. “Credit default swap [ CDS ] spreads “ measure the premium to the risk-free interest rate that a bank can expect to pay in the market for one or five-year loans. The higher the CDS for any given bank, the riskier the market thinks that particular bank’s debt is. Thus, the higher the CDS value, the higher the interest to be paid for insurance protection.

The real value of a bank is determined by comparing the outstanding debts versus cash on hand. If the outstanding debts and bonds are covered by the cash on hand, then the bank is solvent and has liquidity. The liquidity or worthiness of a bank, and company, as well as the worthiness of its debt or credit notes like Credit Default Swap, can be evaluated and expressed as a CDS value in basis points [ bp ] at any time. Here are a few examples [ CDS values will change with time ]:

The riskiest banks in the world reported by Bloomberg on March 17, 2008 were rated as follows: Ferguson CDS risky banks 2008 [8. Jung, Alexander et la. ]

You can estimate just how risky a bank is by the amount of interest it pays its customers. The higher the interest rate, the riskier the bank. For example, Kaupthing, the major bank in Iceland, was paying about 11 percent return on deposits when it had a CDS value of 833 bp on March 17, 2008. After Bear Stearns Bank collapsed, the CDS rating for Kaupthing bank on April 01, 2008, rose sharply to 1000 bp for one-year contracts, with the interest climbing to 15%. The interest rate rising to 15 % is interpreted that the bank needs more cash in order to attract investors. This high interest rate also indicates that insurers of bank debt consider this bank to be a very high failure risk.

To price a CDS we need to know the credit, its default probability and recovery rates, which depend on the level of seniority of the debt, plus market information. A rise indicates deterioration in the perception of credit quality; a decline, the opposite.

The rating agencies, and in particular Bloomberg and Moody’s, provide a long history of statistical information on one-year and cumulative default probabilities, as well as recovery rates for different periods.” [ 10. Attwood ]

At the time of being forced to sell to JPMorgan, Bear Stearns had a CDS rating of about 840 basis points, indicating that it was in an extremely high risk and was probably out of money to cover its debts and going broke!

Another good example to illustrate bank risk is to examine the American bank, Washington Mutual [ WM]. On March 3, 2008, this bank had a credit default swap spread from 468 basis points to 550 basis points. This new increase would have cost Washington Mutual $550,000 per year for five years to insure $10 million in debt. But from a customer point of view, Washington Mutual, during this time period, would pay almost double the interest paid by more solvent banks. A customer would be attracted to open an account at WM not realizing that the higher interest rate meant a higher banking risk.

Another good example to illustrate bank risk is to examine the American bank, Washington Mutual [ WM]. On March 3, 2008, this bank had a credit default swap spread from 468 basis points to 550 basis points. This new increase would have cost Washington Mutual $550,000 per year for five years to insure $10 million in debt. But from a customer point of view, Washington Mutual, during this time period, would pay almost double the interest paid by more solvent banks. A customer would be attracted to open an account at WM not realizing that the higher interest rate meant a higher banking risk.

Mid-March contracts on Seattle-based Washington Mutual increased to a near-record 644 basis points, according to CMA Datavision. With the infusion of new cash in early April, 2008, the five-year debt insurance costs on Washington Mutual fell to about 302.5 basis points, or $302,500 a year to protect $10 million of debt, according to data from Markit Intraday.

Meltdown of Stearns: During the week of March 10, the fourth-largest U.S. investment bank, Bear Stearns, collapsed. Panic-stricken investors, shareholders, employees and other creditors simultaneously demanded their money in a run on the bank, which had become the second-largest trader in speculative financial instruments.

Fear of a capitalist meltdown spread through the financial markets. Giant commercial banks CitiGroup, Bank of America and Wachovia, plus investment banks Lehman Brothers, Merrill Lynch and a host of others, were also swept up in a tsunami of risky investments. All were flooded with subprime mortgages, faulty structured investment vehicles, opaque credit default swaps and other over-valued financial instruments. They were forced to write down hundreds of billions in losses.

Bear Stearns was purchased by rival J.P. Morgan Chase for about $236 million, or $2 a share, after being bailed out by the federal government in mid-March. Bear Stearns had a market value of $3.5 billion on March 14 and $20 billion in January 2007. The Federal Reserve guaranteed $30 billion in the bank’s “less-liquid assets”—mostly mortgage-backed securities that Bear can’t sell.

This all started when “Bear Stearns bet too heavily in the mortgage debt market,” said USA Today in an editorial. Bear put “itself behind too many mortgage-backed portfolios,” and failed to grasp the risks involved in them. “In so doing, it helped inflate a housing bubble, driven in part by the proliferation of wildly inappropriate subprime mortgages.”

The collapse of Bear Stearns spread instantly throughout the global economy. All entities holding CDS debt were affected. Britain’s Northern Rock went belly up, forcing the government to pick up the pieces. Swiss bank UBS, Germany’s Deutsche Bank and other European banks were also caught up in the whirlpool of risky financial instruments. Societe Generale, the French bank that recently reported losses from a rogue trader, also had problems with CDSs. Was this the beginning of a 1929 meltdown? Or would bailing out the banks avoid a crash? [16. Neidenberg ]

Bailout of Stearns:

The bailout was not of Bear Stearns & Co (NYSE:BSC), but rather of big lending and investment banks like Lehman Brothers (NYSE:LEH), Goldman Sachs (NYSE:GS), JPMorgan Chase (NYSE:JPM), and the rest of the primary dealer community.

Credit Default Swap and its derivatives are unregulated. The unregulated market in credit default swaps has twice the face value of the US stock market. It is bigger than the USA NYSE and behaves like a wild west shootout!

Consequently, it should not be a surprise to hear rumors that the bailout was necessary to save wall street from a stock market crash bigger than that of 1928. [17. Brock ]

Most persons are aware that their local small banks are insured up to $ 100,000 by Federal Deposit Insurance Corporation [ FDIC ]. FDIC is a United States government corporation created by the Glass-Steagall Act of 1933.

The FDIC provides deposit insurance which currently guarantees checking and savings deposits in member banks up to $100,000 per depositor. [ FDIC ] The FDIC does not deal in CDS and does not insure these swaps. [ 18.FDIC ]

FDIC is very often confused as being the same as the Federal Reserve. It is not! The Federal Reserve is not part of the Federal Government; it is a private corporation that advises the USA government about the economy. Since the members of Board of Governors of the Fed are appointed by the President, the assumption is that it is but another agency of the Executive Branch, but nothing could be further from the truth. It is owned primarily by private banks that are shareholders and appoint two thirds of the members of the boards of directors of the twelve regional Federal Reserve Banks. Here is a classic example of the fox [predator ] guarding the chickens in the chickencoop!

Conclusion: A huge pyramid of debt was made possible by thirty years of relentless deregulation of financial markets. A new system of “ swap “ banking and loaning was evolved that helps banks and loan institutions make money. It spreads the risk of failure to other parties. The entire monitory system allows all parties to be able to gamble on the loans created. The CDS system is reminiscent of “ there is nothing like power to corrupt power.” And money is power! It is most unfortunate that in the lust for money and power, the bankers and their governments have lost their old fashioned values of right and moral good. We appear to be evolving from free wheeling capitalism to regulated socialism in the banking system. Greed for money and power does not regulate itself!

The trouble with credit-default swaps is that these are thinly traded, have huge counter party risk, are unregulated, difficult to analyze, have shoddy book-keeping and are difficult to monitor. The system uses debt as ‘ hollow ’ credit that has no security backing it up. Banks sell their debt and use it as credit to get money so they can become more solvent.

“ The sacrosanct free market would supposedly regulate itself. The problem with that approach is that regulations are just rules. If there are no rules, the players can cheat; and cheat they have, with a gambler's addiction. In December 2007, the Bank for International Settlements reported derivative trades tallying in at $681 trillion - ten times the gross domestic product of all the countries in the world combined. Somebody is obviously bluffing about the money being brought to the game, and that realization has made for some very jittery markets. “ [ 35. Brown ]

Shadow banking System:

This process has turned investment banks into debt “casino slot “ machines that trade heavily on their own accounts [shadow banking system ] in an attempt to be competitive by generating much needed cash. Central banks have in effect conspired with the smaller bank’s urge to earn fees and use leverage. Using debt as collateral, the intermediaries can sell them to CDS and borrow more.

These debt products are virtually hidden from investors, analysts and regulators, even though they have emerged as one of Wall Street’s most outsized profit engines. They don’t trade openly on public exchanges, and financial services firms disclose few details about them. [ 34. Schwartz, Nelson D. and Creswell ]

With the CDS system, the buyer or seller has more information [ insider information ] about a product or service than his counterpart does. This provides the better-informed party with considerable economic advantage.

Instead of using guns as in the OK coral shoot out, bankers use swaps. As a result, contracts can be traded or swapped from investor to investor without anyone overseeing the trades to ensure the buyer has the resources to cover the losses if the security defaults. The instruments can be bought and sold from both ends — the insured and the insurer.

Schwartz has argued that CDS are not insurance. This raises the validity of using insurance to indemnify CDS. To the extent that CDS are being sold as “insurance,” they are looking more like insurance fraud; and that fact has particularly hit home with the ratings downgrades of the “monoline” insurers and the recent collapse of Bear Stearns, a leading Wall Street investment brokerage. The monolines are so-called because they are allowed to insure only one industry, the bond industry. [ 35. Brown ]

The International Monetary Fund said in March, 2000, that banks were in the worst financial crisis since the Great Depression. The tragedy of Enron is that governments and banking institutions did absolutely nothing to stop the tragedy from reoccurring. The Enron tragedy resurfaced again in 2008. [ 30. Enron tragedy ]

| " Skepticism about credit default insurance is found in a survey conducted in August 2003 of 231 bankers and their customers, regulators, and observers by the Centre for the Study of Financial Innovation, in London. The respondents cited credit default swaps and other complex financial instruments as the biggest risk currently facing the global financial system. “ |

The big banking firms of United States have forced the world banking institutions to play their swap game. It is a travesty that global swap banking game has endangered the security of countries and their monetary institutions by participating in questionable banking schemes like swap derivatives. The demise of Enron and Bear Stearns will continue to swallow not only banks, but countries globally, simply because CDS is a bad Punzi gambling scheme for making money! The swaps game is now endangering the world food supply by allowing swaps to impact commodities [ grains, rice and other foods ].

References:

1. Newman, Rich, “ A beginner’s Guide to Credit Default Swaps,” December 09, 2007 Newman CDS Guide 2007

2. International Swaps and Derivatives Association, Inc., “Contract CDS Syndicated-Secured-Loan CDS-Standard Terms Supplement,” May 22, 2007. International Swaps Ass 2019

3. Wikipedia Encyclopedia, “Credit Default Swaps.“ Wiki: CDS

4. Morgensen, Gretchen, “ Arcane Market is next to face big credit test,” New York Tines, February 17, 2008. Morgensen 1 2008 Morgensen 2

5. Roy Subhas, “ A FALL WORSE THAN THE GREAT DEPRESSION,” The Telegraph, April 01, 2008. Article by Subbas Worst fall 2008 is no longer active

6. Shedlock, Mish, “ Mishs Togele Bonds – Yet Another High Wire Act,” Global Economic Trend Analysis, June 25, 2007 Shelock CDS act 2007

7. Ferguson James “Credit default swaps: How to spot riskiest banks,” MoneyWeek, 03/17/2008. Ferguson CDS risky banks2008

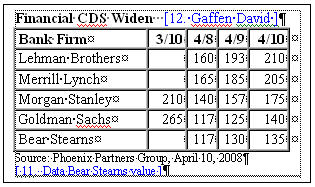

12. Gaffen David, “ Worry Seeps Into Financials (Again),” Wall Street Journal, April 10, 2008 Gaffen Financial worries 2008

16. Neidenberg Milt, “ What lurks behind Bear Stearns bailout? “Worker’s World, April 10, 2008. Neidenberg Bailout Bear Stearns 2008

17. Brock James W.. “The real issue behind saving Bear Stearns: size,” The Christian Science Monitor, April 7, 2008. Brock Reak issue bailout 2008

18. Wikopedia, “Federal Deposit Insurance Corporation.“ Fed Deposit Insur Corp

19. Sharon Bill, “The Federal Reserve - isn’t, “ Between the Cracks, March 31st, 2008. Article by Sharon: Federal Reserve weaknesses 2008 is no longer active.

20. Schwartz, Robert F., “ RISK DISTRIBUTION IN THE CAPITAL MARKETS: CREDIT DEFAULT SWAPS, INSURANCE AND A THEORY OF DEMARCATION. “ Fordham Journal of Corporate & Financial Law, 2007. Article by Schwartz Risk distrubution CDS 2007 is no longer active.

21. Pittman, Mark, Katz Alan and David Mildenberg, “Citigroup, Wells Fargo May Loan Less After Downgrades (Update3), “ Bloomberg, April 8, 2008. Article by Pittman: Bank downgrades 2008 is no longer active

22. ____, “ UPDATE 3-Financial swaps weaken on credit exposures,” Reuters, March 4, 2008. exposure weak CDS 2008

23. Ferguson, James, “Credit Default Swaps: How to spot the riskiest banks?” Money Week, March 17, 2008. Ferguson: Spotting riskiest CDS 2008

24. Hull, John, et la, “The relationship between credit default swap spreads, bond yields, and credit rating announcements,“ University of Toronto, January, 2004. Article by Hull: CDS yields & ratings 2004 is no longer active.

25. Martin Eric, “U.S. Stocks Fall on Profit Concern“ Bloomberg, Apr 08_08: Article by Martin: Stocks fall 2008 is no longer active.

26. Mason, Joseph R., and Rosner, Joshua, “Non Ratings cause mortgage backed securities and collateralized debt obligation market disruptions,“ May 2007.

27. Nolan Gavin, “Back to basics “ Credit, December, 2007. Article by Nolan: Basics of credit 2007 is no longer active.

28. Partnoy, Frank and Skeel, David A., “The Promise and Perils of Credit Derivatives,”

30. Credit derivatives are a speculative innovation in financial markets. They have the potential to allow companies to trade and manage credit risks in much the same way as market risks. The most popular credit derivative is a credit default swap (CDS). This contract provides insurance against a default by a particular company or sovereign entity. The company is known as the reference entity and a default by the company is known as a credit event. The buyer of the insurance makes periodic payments to the seller and in return obtains the right to sell a bond issued by the reference entity for its face value if a credit event occurs.

31. Enron is a classic and famous example of a CDS gone wrong. Envon used CDS as a scheme to finance itself. In 1999, Citigroup had a huge exposure, almost $1.7 billion, to Enron. This amount was four times the bank’s internal limit on such an exposure, so Citigroup used the CDS mechanism to spread their risk. In a deal known as Yosemite, the bank underwrote and sold their Enron corporate bonds as “senior unsecured notes.” Enron stayed in business as long as it could generator investors to provide cash.

The financial problems at Enron spread to not just its subsidiaries but to all those who purchased CDS and similar derivative instruments. Two firms of Enron, water specialist Azurix, doing business in Argentina, and the Dabhol Power Company of India had financial problems and went bust. These subsidiaries, part of a network of more than 3,000 firms linked to Enron, were claimed by the company to be 'unconsolidated affiliates', which do not have to be shown on balance sheets. Enron was “ cooking “ its accounting books to make itself look good and no one monitored these accounting procedures. Indeed, the respectable accounting firm, Arthur Anderson, did the cooking [questionable accounting that kept hundreds of millions of dollars in debt off its books and employees had illegally destroyed thousands of documents and computer records relating to Enron. ] Enron 1 Enron 2 The Enron effect affected everyone world-wide who bought and traded CDS. Enron impact 2001

Enron affected Argentina, England, France, Germany and China. An international example of the impact of Enron impact: J.P. Morgan sold Argentina default swap insurance purchased from Daehan Investment Trust and Securities, a Korean bank. as a way of restructuring its banking system. Article by Enron international affect is no longer active.

The tragedy of Enron is that governments and banking institutions did absolutely nothing to stop the tragedy from reoccurring. The Enron tragedy resurfaced again in 2008.

32. The Economist Briefing, “What went wrong,“ The Economist, March 19, 2008. [ shadow banking system ] Economist briefing 2008

34. Schwartz, Nelson D. And Creswell, Julie, “ What Created This Monster? “ New York Times, March 23, 2008 Schwartz Creation of CDS 2008

35. Brown, Ellen, “ Credit Default Swaps: Evolving Financial Meltdown and Derivative Disaster Du Jour, “ Global Research, April 11, 2008. Brown: CDS & meltdown 2008

“A Ponzi scheme is a form of pyramid scheme in which new investors must continually be sucked in at the bottom to support the investors at the top. In this case, new borrowers must continually be sucked in to support the creditors at the top. The Wall Street Ponzi scheme is built on “fractional reserve” lending, which allows banks to create “credit” (or “debt”) with accounting entries. Banks are now allowed to lend from 10 to 30 times their “reserves,” essentially counterfeiting the money they lend. Over 97 percent of the U.S. money supply (M3) has been created by banks in this way.2 The problem is that banks create only the principal and not the interest necessary to pay back their loans, so new borrowers must continually be found to take out new loans just to create enough “money” (or “credit”) to service the old loans composing the money supply. The scramble to find new debtors has now gone on for over 300 years - ever since the founding of the Bank of England in 1694 – until the whole world has become mired in debt to the bankers' private money monopoly. The Ponzi scheme has finally reached its mathematical limits: we are “all borrowed up.”

36. Pearlstein Steven, a Washington Post business columnist, was honored with the Pulitzer Prize recently for commentary for his columns about mounting problems in the financial markets. Pearlstein was online Wednesday, April 2, at 11 a.m. ET to discuss financial regulation reform and lessons from the current crisis.

Thoiry: “ Thoiry, France: I have, in an amateur manner, tried to explain to my wife the basic principles of the $45 trillion credit defaults swaps market: Imagine that instead of going to a regulated insurance company we insure our house with a neighbor. We do this without knowing if our neighbor has sufficient funds to pay us if our house burns down. Our neighbor goes down to the local bar and (without telling us) sells the insurance contract to a stranger without making sure that he has funds to cover a fire in our house. Ten other people in the bar decide to get in on the action and sell and buy among themselves five contracts insuring our house against fire (i.e. making bets that our house will or will not burn down). In the end there are six insurance contracts on our house between people who do not know each other and who may or may not have funds to cover a fire. Imagine the mess if the house burns down...My wife does not believe that anyone would be this stupid. I claim that there are thousands of investment bankers and hedge fund managers with million dollar bonuses who are in fact this stupid. Is this correct? And what will happen when companies start to "burn down" in the coming recession?

Pearlstein Steven Example of CDS by Steven Pearlstein: You have it precisely correct. I am laughing out loud at reading your comment because I tried to do the same thing with my wife, using the same analogy, and she looked at me as if I was nuts. But it is important for everyone to understand this market, because it is a good metaphor for how we've run off the track. What started out as a legitimate hedging instrument, perhaps, has now morphed into an instrument not only of speculation but unfetterd market manipulation (SEC, please note). Moreoever, what you didn't explain to your wife is that these insurance contracts are then bought and sold on secondary markets using large amounts of debt--debt that in many cases is given by the very banks whose "house" was being insured. So you get investors who may be doubling down on their insurance bets by borrowing from the same banks, or from hedge funds that have borrowed from the same bank. That's why this is so complex, why it is so intertwined, and why nobody knows what would happen if one major institution fails, although we can surmise that the ripple effects would be significant and difficult to know in advance. “ Pearlstein: example CDS