Symptoms Versus Real Problems

By Professor Patricia Danzon

THE WHARTON SCHOOL UNIVERSITY OF PENNSYLVANIA

Date published September, 1991.

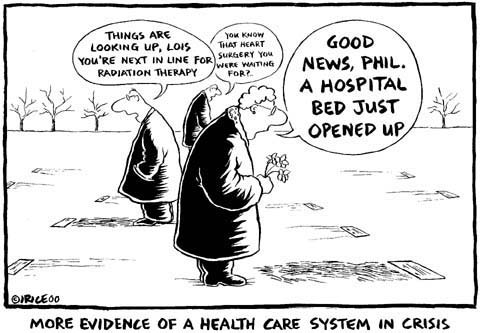

Update: Since 1991 nothing has changed that much .... except trying to insure as many as possible with Obamacare that needs fixing. USA and most countries are using an outdated health care and medical system that is grossly outdated. USA continues in a state of health care crisis. Walter Sorochan Emeritus Professor San Diego State University

INTRODUCTION

Several countries around the world, including the United Kingdom and now New Zealand, are trying to introduce elements of competition into their publicly-financed health care systems. These initiatives are constrained by the fear that moving from a predominantly public monopoly towards competitive private insurance will necessarily unleash all the evils of the United States health care system - relentless cost inflation, vast disparities in access to care and deprivation of the poor.

The United States health care system has been aptly described by Alain Enthoven as "poverty in the midst of excess." The United States is unique in relying largely on private health insurance, except for the public programmes Medicare and Medicaid, which serve the elderly and some of the poor, respectively. The United States also spends a larger fraction of GNP on health care than any other country - 12 percent, in contrast to under 10 percent in most other OECD countries and 7 percent in New Zealand - and more per capita in absolute dollars. The United States is also unique among developed countries in having roughly 15 percent of the population (33 million people) without health insurance

as of 1991. This is deplorable and is deplored by most American citizens - hence the raging debate over national health insurance. But while one cannot condone the status quo, it is a mistake to jump to the conclusion that correlation implies causation, and that excessive cost inflation and lack of access are the inevitable consequences of private health insurance.

The United States health care system has been aptly described by Alain Enthoven as "poverty in the midst of excess." The United States is unique in relying largely on private health insurance, except for the public programmes Medicare and Medicaid, which serve the elderly and some of the poor, respectively. The United States also spends a larger fraction of GNP on health care than any other country - 12 percent, in contrast to under 10 percent in most other OECD countries and 7 percent in New Zealand - and more per capita in absolute dollars. The United States is also unique among developed countries in having roughly 15 percent of the population (33 million people) without health insurance

as of 1991. This is deplorable and is deplored by most American citizens - hence the raging debate over national health insurance. But while one cannot condone the status quo, it is a mistake to jump to the conclusion that correlation implies causation, and that excessive cost inflation and lack of access are the inevitable consequences of private health insurance.

How Meaningful are the Statistics?

Some of these much-abused 'statistics' should be put in perspective.

More fundamentally, the available mortality and morbidity data cannot measure the multidimensional value to consumers of many of the health services that are routinely more available in the United States. These benefits include the information that comes from more frequent use of MRI scans and other diagnostic techniques; greater access to elective procedures such as hip replacements that reduce pain and improve well-being, particularly for the elderly; greater freedom of choice of physician, location and timing of treatment.

I would certainly not argue that there is no waste in the United States system. Use of many services is certainly abused, and many cost more than they are worth, because of distortions in insurance markets that are discussed below. But much of the additional care that Americans consume does have some benefits that are omitted from simple comparisons of cost differences that ignore real but unquantifiable benefit differences. The extreme view, that Americans just pay more for the same level of health benefits, is clearly wrong.

THE REAL PROBLEM: MISGUIDED PUBLIC POLICY

Regardless of how much benefit Americans or others really get from United States health care spending, it is critical to understand that, to the extent that there is waste and gross inequity in the United States system, this is driven largely by misguided public policy rather than fundamental flaws in competitive markets and private financing of health care. Neither the United States nor any other country has tried a well-designed, undistorted system of private health care financing. The United States system is heavily influenced by government tax policy and other cost-increasing regulations, and by a lack of appropriate subsidies and other interventions to assure universal access. Indeed the worst evils of the United States system are not the inevitable result of private insurance; rather, they flow from badly designed government policies.

Tax Subsidy to Employer Health Insurance

Chief among the distorting government policies is the tax rule that employer contributions to health insurance are tax-exempt income to employees. This exemption applies to federal and state income and payroll tax, from zero for workers who pay no tax up to 50 percent or more for higher income employees, with an overall average of 33 percent. For example, for an employee in a 40 percent marginal tax bracket, $100 of employer-provided health insurance effectively costs only $60 in terms of after-tax income. This subsidy is sufficient to more than offset the administrative load on health insurance. Consequently most workers are better off having insurance for virtually all the health care they expect to use, even though the insurance overhead adds 10-20 percent to the cost of the services, because this is more than offset by the tax subsidy.

This tax subsidy plays a critical role in the inflation and the inequities of the United States health care system. It leads employees to choose very comprehensive plans with relatively low levels of co-payment and, until recently, few other mechanisms for controlling costs. Although nominal co-payment levels have increased in recent years, in reality even these co-payments are tax-subsidized under flexible spending accounts which are common in most large firms and permit employees to shelter from taxes a certain level of out-of-pocket spending on health or other insurance benefits. High tax-induced levels of health insurance in turn have contributed to price, quantity and technology dimensions of health care cost inflation, making consumers insensitive to prices, fuelling the demand for costly technologies and undermining demand for cost-reducing technologies.

The structure of the tax-subsidy is also fundamental to the inequities and coverage gaps of the United States system. Because the value of the subsidy rises with the employee's marginal tax rate, it is highly regressive and is of little or no value to low income families. Moreover, because the subsidy applies only to employer contributions, those who do not obtain insurance through employment face much higher costs for health insurance. (Individual insurance premiums are tax-deductible only if total health expenditures exceed 7.5 percent of adjusted gross income, which is rare.) Further, the employment-focus of the subsidy has probably stunted the formation of other insurance-purchasing groups, such as banks, which could offer some of the scale economies of group purchasing but have little incentive to develop such plans when most of the population is better off getting insurance through the workplace.

Insurance Regulation

The regulation of insurance has also operated to increase the cost of insurance for individuals and small firms. Commercial insurers in the United States are regulated at the state level, but self-insured employer plans are exempt from this state regulation under federal regulation of employer benefit plans (ERISA). As state regulation has become more onerous, an increasing number of medium and large firms have self-insured, but small firms and individuals do not have this option and have been left facing the higher costs of commercial insurance.

The most costly form of state regulation is mandated minimum benefit laws, which require that commercial insurers cover specified services such as alcoholism treatment, chiropractors, psychologists, in vitro fertilization, acupuncture, etc. There are over 800 state mandates in 1991. In a well-designed system of competing health insurance plans, all plans should be required to cover a minimum set of basic services that are known to be cost-justified. But such a cost-benefit test has only recently been applied to new mandates in a few states, and old mandates have usually been grandfathered.

These mandated benefits (which are often instigated by and inure to the benefit of the providers of the services) increase insurance costs disproportionately for small firms and reduce their willingness to offer plans.

Small firms are also disproportionately burdened by state financing of high risk health insurance pools via levies on commercial insurers. Since such levies must ultimately be passed on as a cost of providing insurance, the burden falls only on those firms that are too small to self-insure.

Power of Professionals

It is sometimes argued that competition cannot work in medical markets because of monopoly power enjoyed by providers. It is said that many individual patients are poorly informed and are not cost-conscious price shoppers when it comes to health care, particularly if they are heavily insured. But competitive health insurance markets can respond to this problem. Insurers and employers can and do act as cost-conscious buyers on behalf of consumers. The array of innovations in health plan design - some of which have been copied in other countries - offer consumers a menu of choices that trade off lower cost, on the one hand, with freedom of choice and comprehensive financial cover on the other. There is no free lunch in health insurance, public or private: consumers cannot have unrestricted choice, total financial protection and low cost. Plans compete by developing innovative ways to control providers without imposing high co-payments on consumers. With insurers acting as surrogates for consumers, individual providers have very little market power. Competition could work well to provide consumers with whatever trade-off between cost and free choice they prefer.

But such competition is being emasculated in some states by provider-initiated legislation that restricts competition, increases provider incomes and raises costs for consumers. Mandated benefits are just one example. Laws against the corporate practice of medicine stunted the growth of HMOs for many years. Freedom-of-choice laws in some states limit the ability of employers and insurers to contract selectively with lower cost providers to form preferred provider organizations (PPOs) that have demonstrated an ability to reduce costs. Limits on consumer co-payments for using out-of-plan providers obstruct the formation of point-of-service plans, which are a popular hybrid type of plan that permits consumers to use out-of-plan providers if they are willing to pay more but not the full cost out-of-pocket. In other states, providers are hamstringing managed care plans through laws that impose restrictions on utilization review procedures.

The Public Safety Net

Although some 15 percent of the United States population do not formally have either private or public insurance, in fact they have quasi-insurance through an informal, and haphazard, publicly-subsidized safety net with several components. Public hospitals are required to operate as providers of last resort and public clinics provide outpatient services. Private not-for-profit hospitals are under pressure to provide some free care in order to retain their tax-favoured status (exemption from corporate profit tax and entitlement to issue tax-exempt bonds). The 'near poor' whose income is normally above the level that would entitle them to Medicaid can 'spend down' to become eligible for Medicaid if they incur large medical expenses.

Given this safety net, the decision not to buy insurance may be a rational decision for many without employment-based coverage. Granted this safety net quasi-insurance may entail lower quality care, long waits in public hospitals, and the embarrassment of relying on charity or being a bad debt. But the alternative for those without employment-based coverage is to pay a high price for an individual policy, with no tax subsidy, mandated benefits that may be of relatively low value, and a high administrative load.

The Uneasy Co-Existence of Public and Private Programs

Medicare and Medicaid were established in 1966 and now account for over 40 percent of personal health spending. As the most rapidly growing component of the federal budget, Medicare has contributed to health care spending directly and indirectly, by driving up costs for the private sector. Before the introduction of DRG (Diagnosis Related Group) payments for hospitals in 1983, Medicare paid hospitals based on the share of accounting costs attributable to Medicare patients. Retroactive cost-based reimbursement is like a blank cheque. It eliminates hospitals' incentives to control costs. It also creates powerful incentives to adopt new technologies that enable hospitals to compete for patients and physicians on the basis of quality and technological sophistication, rather than price and cost-effective care.

Although Medicare payments to hospitals have slowed since the adoption of DRGs, to the extent that Medicare now pays less than its fair share of joint overhead costs, Medicare has simply shifted costs to private payers. Medicaid is even more blatant in cost-shifting. Medicaid rates in some states are below the marginal cost of serving Medicaid patients, leading to problems of access for these patients.

For physicians' services Medicare has traditionally paid fee-for-service, subject to a limit that depends on the doctor's usual charge to private patients. Not surprisingly, this creates incentives for doctors to raise fees to private patients in order to increase their reimbursement from private patients. Since the early 1980s, Medicare has regulated the rate of increase of physicians' fees. But Medicare has not introduced successful managed care plans. The volume of physician services has exploded.

Public programs are intrinsically ill-equipped to design and implement provider-targeted strategies for controlling costs, such as selective contracting and managed care. But the patient-targeted strategy of co-payments is ill-suited for many Medicare and Medicaid beneficiaries who are the elderly and the poor. This is why both Medicare and Medicaid are increasingly adopting strategies to permit patients to 'voucher out' by enroling with HMOs and other private plans.

Malpractice liability

No one knows exactly how much the consumer-oriented malpractice system adds to United States health care costs but it is certainly a factor. Physicians in the United States are five times as likely to be sued as their Canadian counterparts. Malpractice insurance premiums are only roughly two percent of United States health care spending. But there are no good estimates of the cost of 'defensive medicine' - the additional tests, time spent and procedures performed to reduce the risk of being sued.

Defensive medicine is hard to measure because much of the low-benefit care would be provided even without liability because patients want it, given the distorted costs that they face for health insurance. Even if one could tease out changes in medical practice that are induced by insurance from those that are liability-induced, it is even more difficult to separate the purely wasteful defensive medicine from cost-justified precautions that reduce the risk of injury to patients. It is these cost-justified safety measures that the tort system is intended to encourage.

The United States system of tort liability is certainly poorly designed, excessively costly to administer and adds unnecessarily to health care costs. But it is a mistake to conclude from the United States experience that a system of no liability is clearly superior, and that any system that retains any element of provider liability for fault, however defined, is fatally flawed. An attractive third alternative is an 'administrative fault-based' system. The essential features of this proposal are: an administrative agency rather than courts and juries to decide cases; scheduled damage awards and limits on payments for pain and suffering; but the retention of liability on the part of providers for fault or failure to take reasonable or cost-justified care, defined as precisely as possible. Such a system would have its problems, as do all the alternative systems proposed for handling the issue of medical negligence. But it is probably the best of the imperfect alternatives, because it retains the best components of fault-based, tort systems and administrative no-fault systems, but avoids the excesses of both.

CONCLUSION

It is naive and mistaken to conclude that the United States experience clearly demonstrates the inability of competitive insurance to provide appropriately comprehensive health care coverage at reasonable cost.

The United States experience is heavily distorted by the open-ended, employment-targeted tax subsidy to insurance that creates powerful incentives for the rich to buy cost-increasing forms of insurance, but offers no financial assistance to the poor or those who lack employer-provided coverage. Combine this with cost-increasing regulations that raise costs for commercial insurers and raise incomes for providers, a publicly-subsidized safety net of free care and poorly designed public programs, and you have a blueprint for poverty in the midst of excess.

However, the responsibility lies with misguided government policy, not private insurance markets. Public policy in the United States has many features that are counterproductive to the efficient functioning of competitive private insurance markets. But it has not taken the steps necessary to ensure that a competitive private insurance system achieves the goals of universal coverage at a minimum level of basic care. These necessary steps include mandating that everyone has coverage and providing appropriately-designed assistance to make that coverage affordable to the poor.

Any country that is in the process of rethinking its health policy should clearly understand the extent to which counterproductive policies, on the one hand, and the lack of other essential interventions, on the other hand, contribute to the problems of the United States health care system.

Much of this is already well-understood by health analysts and policy makers in the United States. So why does it persist? The fundamental problem is that expanding health insurance coverage for the uninsured will add to the federal deficit unless the additional care for the uninsured is financed by reducing the tax subsidies to those of middle and upper income. The tax subsidy alone is estimated at over $40 billion. This, together with the potential savings that could be realized from reducing existing programs for the uninsured (public hospitals and clinics, uncompensated care payments) would be more than enough to pay for insurance for the uninsured poor, and partial subsidies for the near poor.

But the beneficiaries of the tax-subsidy include many powerful interest groups: large employers, labor unions, middle and upper income workers, and the medical profession. That is a powerful alliance that no politician has yet had the courage to take on. Similarly, tort reform is opposed by the plaintiff's bar, although significant progress has been made in some states.

But as the debate continues there are some promising signs that a reasonable compromise may be reached - one that retains the competitive private market system, but makes coverage universal, limits subsidies for better-off people and provides appropriate subsidies for those on low incomes.

Reference:

website