Summarized by Walter Sorochan

Posted 2009 Updated February 8, 2011

|

With the exception of one find off the coast of Brazil, no major new oil fields have been discovered in over 35 years. More than 80% of the oil pumped today comes from wells that are at least 20 years old — and those oil fields are now in decline. Alaskan fields are in decline, and so are Mexico’s. The U.K., one of the world’s great oil exporters for 25 years, will be importing oil within the decade. And despite promises to increase oil production over the past three years, Saudi Arabia has been unable to boost output by a single drop! Now, according to the U.S. Army Corps of Engineers, there are only 41 years-worth of proven oil reserves left on Earth. And to make matters worse, not a single oil refinery has been built in America since 1976 — while the number of operational refineries is falling fast. In 1981, the U.S. had 324 oil refineries. Today [ 2008 ], there are just 132. |

Two oil issues have been used by TV and newspaper reporters that really confused politicians in the past election year. One issue has to do with use of the term "peak oil" and the other issue has to do with politicians stating that the way to solve the energy crisis and dependence on foreign oil is to drill for more oil! Both issues are related. We need to understand the first, that is, peak oil, before unraveling the spin on " drill for more oil!" This documented paper presents information as a time-line on oil supply in the world.

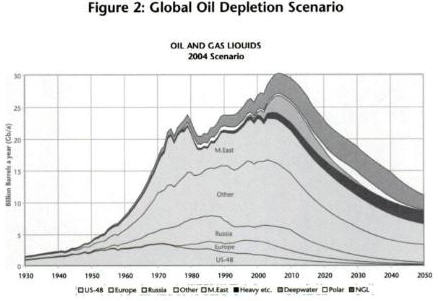

Peak Oil --- What is it?"Peak oil is the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline. The concept is based on the observed production rates of individual oil wells, and the combined production rate of a field of related oil wells. The aggregate production rate from an oil field over time appears to grow exponentially until the rate peaks and then declines, sometimes rapidly, until the field is depleted. It has been shown to be applicable to the sum of a nation’s domestic production rate, and is similarly applied to the global rate of petroleum production. It is important to note that peak oil is not about running out of oil, but the peaking and subsequent decline of the production rate of oil." Peak oil definition

Peak Oil as a concept applies globally, but it is based on the summation of individual nations experiencing peak oil. In State of the World 2005, Worldwatch Institute observes that oil production is in decline in 33 of the 48 largest oil-producing countries. [ Blanchard, Khebab & oil drum projections,Klare, WorldWatch Institute; see references for countries ] Other countries have also passed their individual oil production peaks. Peak oil concept worldwide

Focus on the current oil crisis in United States in 2008 has been made to appear as if the energy-oil crisis just happened innocently out of nowhere. But such is not the case. We have had numerous warnings from energy and oil experts since 1956.

In 1956, geologist M King Hubbert, [ Deffeyes, Hubbert ] predicted that U.S. oil production would peak in the early 1970s. Almost everyone, inside and outside the oil industry, rejected Hubbert's analysis. The controversy raged until 1970, when U.S. production of crude oil began to fall. Hubbert was right.

His logistic model, now called Hubbert peak theory, and its variants have been shown to be descriptive with reasonable accuracy of the peak and decline of production from oil wells, fields, regions, and countries. [ Deffeyes, Hubbert ]

Another example: Reynolds, an associate professor of oil and energy economics at the University of Alaska Fairbanks, alluded to it in 2004:

“ A peak in world production will soon be upon us and will hit today's economy even as hard as the 1930s Great Depression. [ Reynolds, printed in 2004 ] The Association for the Study of Peak Oil, also supports this time-line. Unfortunately, most government and non-government reports support a 10- to 30-year time frame before oil shortages occur. “ [ Reynolds ]

Then there has been a continuing debate since 2004 over why USA really went to war in Iraq. The debate connects the invasion of Iraq to US dependence on oil.

"The elephant in the drawing room was the fact that global oil production is likely to peak within about a decade. Aggregate oil production in the developed world has been falling since 1997, and all major forecasters expect world output excluding Opec to peak by the middle of the next decade. From then on everything depends on the cartel, but unfortunately there is growing evidence that Opec's members have been exaggerating the size of their reserves for decades."

"Oil consultancy PFC Energy briefed Dick Cheney in 2005 that on a more realistic assessment of Opec's reserves, its production could peak by 2015. A report by the US Department of Energy, also in 2005, concluded that without a crash program of mitigation 20 years before the event, the economic and social impacts of the oil peak would be "unprecedented." [ Strahan, 2007 ]

Porter reported in 2005 a similar article [ Hirsch ] that the world was nearing peak oil production:

“ Authored by Robert L. Hirsch, Roger Bezdek and Robert Wendling and entitled the Peaking of World Oil production: Impacts, Mitigation, & Risk Management, the report is an assessment requested by the US Department of Energy (DoE), National Energy Technology Laboratory."

"It was prepared by Hirsch, who is a senior energy programme adviser at the private scientific and military company, Science Applications International Corporation (SAIC)."

"But this brand new senior-level report on "peak oil" is unprecedented in US government circles. It is not just the existence of the report itself that is such a landmark in the current oil debate. Its conclusions also pull no punches."

Uncertain timing

"World oil peaking is going to happen," the report says. Only the "timing is uncertain." "The authors of the report also dismiss the power of the markets to solve any oil peak. They call for the intervention of governments. But also they rather worryingly point to a need to exclude public debate and environmental concerns from the process. They say this is needed to speed up decision-making."

"Intervention by governments will be required, because the economic and social implications of oil peaking would otherwise be chaotic. But the process will not be easy. Expediency may require major changes to ... lengthy environmental reviews and lengthy public involvement."

"Hirsch notes, despite arguments from the major oil companies and producer nations, that new finds of oil are not replacing oil consumed each year. Despite the advances in technology reserves are becoming increasingly difficult to replace.“ [ Porter, 2005 ]

All these warning signals went unheeded in the United States government. Political candidates cried out that we needed to stop our dependence on crude oil and that the only way to do so was to drill for more oil. The spin put on solving the dependence on oil was just that --- and it fooled the general public into a false belief that we needed to drill for oil.

"As of October 30, 2008, “the oil and other commodity markets seem seized with the notion that a rip-roaring, world engulfing depression is on the way that will demolish oil consumption. People are actually starting to talk about oil falling all the way to $20 a barrel again. Is this likely or even remotely possible?" [ Whipple, 2008 ]

"US oil consumption, especially the demand for gasoline has fallen as auto owners have started to drive fewer miles this year. This has probably sent the signal to OPEC and other oil exporting nations that the demand for fossil oil has temporarily slowed down. This signal, in turn, has also slowed the peaking of oil production."

"Keep in mind the basic proposition of peak oil is that the world is still burning oil at the rate of 31 billion barrels a year. Seventy five million barrels a day are coming from currently producing fields that with each passing year will produce anywhere from 4 to 8 percent less oil." [ Whipple, 2008 ] [ Heinberg ]

"The Financial Times has leaked the results of the International Energy Agency's [ IEA ] long-awaited study of the depletion profiles of the world's 400 largest oilfields, indicating that, "Without extra investment to raise production, the natural annual rate of output decline is 9.1 per cent." This is a stunning percentage figure."

"Considering regular crude oil only, this means that 6.825 million barrels a day of new production capacity must come on line each year just to keep up with the aggregate natural decline rate in existing oilfields. That's a new Saudi Arabia every 18 months. The Financial Times story goes on:"

"The findings suggest the world will struggle to produce enough oil to make up for steep declines in existing fields, such as those in the North Sea, Russia and Alaska, and meet long-term demand. The effort will become even more acute as [oil] prices fall and investment decisions are delayed.""This is putting it mildly. Investment capital is being vaporized almost daily in a global deflationary bonfire of unprecedented ferocity. Oil production projects are being mothballed left and right. Inter alia, the IEA takes the requisite swat at "peak oil theorists," who, the agency somehow still believes, are saying that the world is "running out of oil." Of course that's NOT what peak oil theorists say, but a correct summation of their position would have to be followed with a statement to the effect that, "Our research supports their position," which would be just too embarrassing."

"Sadly, the IEA feels it must pull its punch even further. With adequate investment in new small oilfields and unconventional sources like tarsands, it insists, the world can still achieve higher levels of production. In other words, if the $12 trillion that vanished from the world stock markets last week were invested in new tarsands projects, then theoretically a few more years of total oil production growth could be eked out (not growth in net energy production, mind you, but in the gross—and I do mean gross—production of exotic, very expensive stuff that it's physically possible to run your car on, assuming you could afford to do so)."

"Of course, any realistic assessment either of the likelihood of that level of investment appearing, or of the ability of new projects to really produce a sufficient rate of flow regardless of the size of the cash infusion, would end merely in a hearty belly-laugh."

"Evidently peeved about being scooped on its planned November 12 press conference roll-out of the study, the IEA has disavowed the Financial Times story. But if nine percent is even close to being the final figure, then it's absolutely clear:" "July 2008 was the all-time peak in world oil production." Don't expect anyone at the IEA to officially admit that fact until 2025 or so. But among those who pay attention to the evidence and the terms of the debate, further ink need not be spilled in speculation."

"Peak oil is history.” [ Heinberg ]

|

Concept of peak oil is based on reality, history & not theory. World reaching a peak in oil discoveries is real!

The world is approching an oil, an economic, a food and a water crises as of

February 6, 2011. |

For videos on peak oil, oil supplies and so on, visit: oil videos

References:

Blanchard Roger, "Media's advice for increasing global oil production," Energy Bulletin, Nov 17 2007. media article

Brandt, A. R. (2007), "Testing Hubbert" (PDF), Energy Policy 35 (5): 3074–3088, doi:10.1016/j.enpol.2006.11.004, Brandt: testing for oil

Deffeyes Kenneth, Hubbert's Peak: The Impending world oil crisis, Princton University Press, 2008. Hubbert textbook

Heinberg Richard, “Nine Percent,” Post Carbon Institute, October 29, 2008. Heinberg projections

Hirsch Robert, Roger Bezdek, Robert Wendling, “ PEAKING OF WORLD OIL PRODUCTION: IMPACTS, MITIGATION, & RISK MANAGEMENT Report, February 2005 Prediction oil peak

This report was prepared as an account of work sponsored by an agency of the United States Government.

Hubbert, M. King (1956-06). "Nuclear Energy and the Fossil Fuels 'Drilling and Production Practice'" (PDF). API. Retrieved on 2008-04-18.

Hubbert M King, Hubbert's Peak, wikipedia. Hubert peak oil theory

Khebab, "Peak Oil Update - August 2008: Production Forecasts and EIA Oil Production Numbers," The Oil Drum, September 13, 2008 Oil drum projections

The Oil Drum is a website devoted to the discussion of energy issues and their impact on society. The site is a resource for information on peak oil, and related concepts such as oil megaprojects.

Klare Michael T., "The Impending Decline of Saudi Oil Output:Matt Simmons' Bombshell," Tom Dispatch,June 26, 2005. S Arabia oil peak

Klare, Michael,"Tomgram: Michael Klare on a Saudi Oil Bombshell," Tom Dispatch,June 26, 2005 S Arabia oil peak

_____, Peak Oil," Wikipedia. Peak oil defined

Peak Oil: The following list shows significant oil-producing nations and their approximate peak oil production years, organized by year.

Japan: 1932 (assumed; source does not specify)

Germany: 1966

Libya: 1970

Venezuela: 1970

USA: 1970

Iran: 1974

Nigeria: 1979

Tobago: 1981

Egypt: 1987

Russia: an artificial peak occurred in 1987 shortly before the Collapse of the Soviet Union, but production subsequently recovered, making Russia the second largest oil exporter in the world. Figures from early 2008, statements by officials, and analysis suggest that production may have peaked in 2006/2007.[129][130] Lukoil vice president Leonid Fedun has said $1 trillion would have to be spent on developing new reserves if current production levels were to be maintained.

France: 1988

Indonesia: 1991

Syria: 1996

India: 1997

New Zealand: 1997

UK: 1999

Norway: 2000

Oman: 2000

Mexico: 2004

Australia (disputed): 2004; 2001

Peak oil production has not been reached in the following nations (these numbers are estimates and subject to revision):

Iraq: 2018

Kuwait: 2013

Saudi Arabia: 2014

In addition, the most recent International Energy Agency and US Energy Information Administration production data show record and rising production in Canada and China. Peak oil concept worldwide

Porter Adam, “US report acknowledges peak oil threat,” Energy Bulletin, March, 2005, Perpignan, France. US report

Reynolds Doug, “Time to prepare for the coming peak in world oil production,” Fairbanks News-Miner, December 26, 2004. Alaska oil

Doug Reynolds is an associate professor of oil and energy economics at the University of Alaska Fairbanks and author of "Scarcity and Growth Considering Oil and Energy", and "Alaska and North Slope Natural Gas." His e-mail address is ffdbr@uaf.edu.

Strahan, David, “The real casus belli: peak oil,” The Guardian, June 26, 2007. England oil future

David Strahan is the author of The Last Oil Shock: A Survival Guide to the Imminent Extinction of Petroleum Man Lastoilshock.com

Whipple Tom, “The peak oil crisis: A steepening slope,” Falls ChurchNews-Press, Virginia, [ Published also Energy Bulletin ], October 30,2008. Peak oil crisis

WorldWatch Institute (2005-01-01). State of the World 2005: Redefining Global Security. New York: Norton, 107. ISBN 0-393-32666-7.