By Walter Sorochan Emeritus Professor: San Diego State University

February 12, 2009

The BIG Problem: We don't have one big economic problem; instead we have a series of inter-related problems that manifest themselves in how we politic, do business and live.

As a country we have strayed away from the original constitutional intent of the fathers of the constitution. The government of today is broken; it is not working as it was intended.

"I know no safe depository of the ultimate powers of the society but the people themselves, and if we think them not enlightened enough to exercise their control with a wholesome discretion, the remedy is not to take it from them, but to inform their discretion by education. This is the true corrective of abuses of constitutional power." |

"I see in the near future a crisis approaching. It unnerves me and causes me to tremble for the safety of my country. The money powers prays upon the nation in times of peace and conspires against it in times of adversity. It denounces, as public enemies, all who question its methods or throw light upon its crimes. Corporations have been enthroned, and an era of corruption in high places will follow, and the money power of the country will endeavor to prolong its reign by working upon the prejudices of the people until the wealth is aggregated in the hands of a few, and the Republic is destroyed." |

Our politicians have been tinkering with the constitution in ways that make it appear that the constitution is not being

changed. But the ammendments already passed have altered the constitution.

Furthermore, legislation that has been passed, such as removing control of how derivatives or SWAPS can be sold and

bought on a risk for profit basis has also changed small aspects of the constitution.

Our politicians have been tinkering with the constitution in ways that make it appear that the constitution is not being

changed. But the ammendments already passed have altered the constitution.

Furthermore, legislation that has been passed, such as removing control of how derivatives or SWAPS can be sold and

bought on a risk for profit basis has also changed small aspects of the constitution.

Problem 1: SWAPS or Credit Defaut Swaps, or CDS. Making a fast buck with CDS is what caused our economic problems to explode! This is a scheme of swaping and loaning created by a graduate student who worked for JP Morgan bank in the 1980s. It evolved an entire new monitary system that allowed all parties to be able to gamble on loans created. In 2001 banks began using a special way of providing collateral for money they were borrowing from investment banks and others.

Enron , the energy corporation from Houston, borrowed and exploited the idea of CDS from JP Morgan Chase Bank

in the early 1980s. This financial instrument exchanged or swapped paper debt for collateral that came from a pyramid scheme of

continuous investors. The new instrument was called the

Credit Default Swap [ CDS ] and was used as an insurance to secure

paper notes or loans and also generate income for Enron.

Enron , the energy corporation from Houston, borrowed and exploited the idea of CDS from JP Morgan Chase Bank

in the early 1980s. This financial instrument exchanged or swapped paper debt for collateral that came from a pyramid scheme of

continuous investors. The new instrument was called the

Credit Default Swap [ CDS ] and was used as an insurance to secure

paper notes or loans and also generate income for Enron.

Without going into details [ for more information on SWAPS or CDS go to:

CDS |

Enron ],

Without going into details [ for more information on SWAPS or CDS go to:

CDS |

Enron ],

SWAPS created a lot of unsecured paper debt, classified as derivatives, that was discounted at each transaction. This debt paper was unregulated, had shoddy book-keeping, it is hidden, and it had no security to back it up. Congress passed legislation to deregulate it and other derivatives. In summary, not only did the banks, lending and insurance institutions create this messy SWAPS, but our own government passed concenting legislation and allowed it to happen. But no politican has the character of honesty and decency to admit to this debacle. "Our government screwed up royally!"

Now the problem is that no one seems to know where these CDS debt papers are. But we need to ferret these out before we can resolve this swaps issue. Banks carry a lot of these bad and valueless swaps and they don't know where it is. Banks need to get rid of this debt before their books can legally balance. SWAPS are a total loss! The government and banking institutions need to accept this. Giving bailout money to banks does not restore this valueless paper debt. Since banks, as private entities, gambled to make money, they should also accept this loss and not expect public funds to bail them out.

The key here is that banks, as private institutions, must get rid of the bad CDS first and then accept the loss as theirs and not have the public bail them out. SWAPS problem is a unique problem that banks, as for profit entities, created on their own, using bad judgement. Banks are obligated to solve a private problem without public money as bailouts. Reason: Banks gambled on their own and lost. Banks must do it alone, for in their haste and greed to make money, they took the risk, gambled and lost.

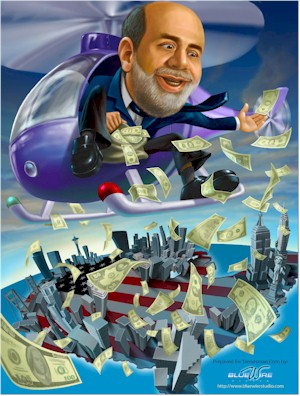

Problem 2: Bailout money. Were it not for the Wallstreet greed and frenzy to make money, we would not be in this economic catastrophy. Who should get the bailout money?

Perhaps no one! Both the banks and those who wanted to get something for nothing down were equally at fault.

But it is persons on main street, with supposedly less financial sophistication than the bankers on

mainstreet, who should get more sympathy and possibly forgiveness and helping out.

These persons need the bailout money more so than banks or Wallstreet gamblers.

Perhaps no one! Both the banks and those who wanted to get something for nothing down were equally at fault.

But it is persons on main street, with supposedly less financial sophistication than the bankers on

mainstreet, who should get more sympathy and possibly forgiveness and helping out.

These persons need the bailout money more so than banks or Wallstreet gamblers.

But the focus on bailout is wrong. We should be focusing on jobs! If mainstreet people have jobs then they can buy goods and pay for them. Jobs help mainstreet directly revive the economy . This is a direct, one-step stimulus recovery.

On the other hand, giving bailout money to banks is an indirect multi-step recovery that has no assurance that it will work. Banks are depositing bailout funds into their own account in order to beef up their under capitalized minimum security capital as required by banking law [ amount approximately 10 % tier two level ].

Big banks are not lending the money to mainstreet customers; instead they lend themselves and make it available to smaller banks and loan companies; but not directly to people that need it the most. So giving bailout money to banks does not directly stimulate mainstreet nor the national economy.

The key here is to make bailout money available directly to homeowners and small businesses; and bypass the banks. If banks fail, so be it! bailout

Congress is mulling over the idea of buying CDS mortgages from banks. Just where is common sense in Washington today? Even a simple simon on mainstreet knows that buying unsecured poison debt is a stupid risk and idea. [ If you can't see, feel, or smell it then it doesn't exist; a common sense test; no radar detection test needed ]

Problem 3: Corporations and lobbyists are strangling desirable legislation. We need to change the political climate in Washington. Our government is being run by corporations and not representatives of the people. Corporations are lobbying and contributing campaign funds to politicians in return for receiving legislative favors.

Democracy for the few |

World corruption |

no quick fix corruption

Problem 3: Corporations and lobbyists are strangling desirable legislation. We need to change the political climate in Washington. Our government is being run by corporations and not representatives of the people. Corporations are lobbying and contributing campaign funds to politicians in return for receiving legislative favors.

Democracy for the few |

World corruption |

no quick fix corruption

President Obama made a campaign promise to change “business as usual in Washington!” But no president can bring about change until the congressmen and senators are elected without apronstrings to corporations.

There will be no change in fixing the broken economy until we fix the broken political system. We need to get a clean government that works for people and not corporations. Attempts to fix the economy will NOT work until this politican flaw is corrected.

Anyone who promises you a quick fix with a bailout is lying and not telling you the truth! no quick fix corruption

|

The three sub-fixes .... bail out for little guys on mainstreet, get rid of swaps, and get rid of corporate lobbyists, all rest on fixing the corporate stranglehold on politics. We must first fix the impact corporations have on government and how it works. Releasing the grip corporations have on politics allows government to begin breathing more freely and responsibly. It would allow government to work and function as intended by the constitution.

|

| Perhaps the first fix should be restoring ethics and morality into government. This could be a slow but long process that could extend for decades. We need to mend the entire society and not just politicians. We may also need to repair the constitution that today is not working very well. Values, character, education & bailout |

Change can be instant or slow. Both are painful and unforgiving. But instant change has the advantage of doing it in one swoop with instant reality while a slow start prolongs change and fogs up reality. Both approaches can accomplish the same thing.

Political “spin” is just cosmetics and a cover-up. It postpones the inevitable: the need to fix corporate America.