By Walter Sorochan Emeritus Professor San Diego State University

Original article by Don Stott: in "Greece and Goldman Sachs," Whiskey & Gunpowder, May 7, 2010.

--- Since 2010, world events have changed and some of the information may be outdated! ---

Posted May 30, 2010; Updated: July 18, 2015.

|

This article is about the background of the economic-political-social problems that have befallen Greece. "Update July 18, 2015: Greece government has balanced its financial budget for the past two years. The debts previous to 2013 are causing Greece & EU the real problems. Rioting in the streets signals that the Greek -Euro problem is not totally resolved as of July 18. Expect more hickups! As of July 6, 2015, Greece has defaulted on all previous loans and has asked the European Union [EU] for another loan. Greek banks are closed until July 7 and probably longer. EU leaders are meeting to consider the Greek disaster, with little sympathy for the Greeks. Meanwhile, stock markets all around the world have been agitated and reacted, with more reactions to come. And all national US evening newscasts gave this international developing story low profile and almost no mention on July 6, 2015???? The stock market crash article "Greece and Goldman Sachs" by Don Stott appeared a day after the NY Stock Market 'Glitch" crash of Thursday, May 6, 2010. Greece and Goldman Sachs |

|

Greece as a country:

The Greeks have been over-spending for decades; thereby causing Greece to be bankrupt for years. teacher pensions

What is the debt crisis? The global debt crisis was in its second stage as governments like Greece and PIIGS deal with the debt absorbed from the private sector [ bank failures ]. Greek banks have been unable to repay their loans; consequently the government has assumed their defaults. In turn, the Greek government has also been unable to repay these loan debts. New debts have been piled on top of previous unpaid debts. Future of Europe

But the real world debt crisis is hidden by national governments borrowing paper money that is not secured by real collateral. Doug Casey best explains it as follows: Casey World debt crisis

"Observing the global flow of money, it seems important to consider the implications of a system built around the notion that debt is considered money. To wit, governments the world over fund their operations largely with money created by issuing debt. Even the payments made on great piles of debt are made using this “debt-money.” So, more debt begets more debt-money begetting more debt. Over time the system is unsupportable.

Which brings us to the case of Greece and other “fringe” countries [ PIIGS ] in the euro-zone. These failing states – and all the nation-states are failing, just at varying rates – need to sell a lot of debt in order to generate the debt-money needed to keep the government’s doors open, but investors, noting just how much debt has piled up, are wary of owning more.

And that gives rise to what is one of the thorniest problems resulting from a systematic reliance on debt-money – the demand for higher interest rates to offset the actual risks of owning the debt-money of an over-indebted state.

But it’s even worse than that. To understand why, let’s reduce the situation to more human terms.

Imagine for a moment, being approached by your deadbeat cousin for a $1,000 loan. In exchange, he offers you an IOU that says he will pay you back in specie, with interest, at some point down the road. Now, consider the same situation, but in a world where debt is treated as money. Now, instead of lending him the $1,000 in exchange for an IOU that promises he’ll pay you back your $1,000 plus interest, he promises to pay you back, but only with another IOU.

This is the net result of using debt as money.

Investors are now looking at the mountain of debt looming over Greece and balking, causing that country to raise rates to attract their money – which, in turn, causes losses to existing debt holders and, over time, ratchets up the interest expense on the existing piles of debt. It doesn’t take a genius to see the potential for yet higher and higher interest rates being demanded, and that results in the need to gin up yet more debt-money. This all gets quickly circular.

For the moment, the anxious market believes that the debt-money that trades under the “dollar” brand is of a superior quality to that of the euro (among others), and so the money flows back this way.

But the irony is that whatever brand of the stuff you own, it is still just the same thing: debt-money. Which is to say, an IOU masquerading as money.

Money should be a reliable store of wealth. It is hard to use that term when talking about an obligation that someone else needs to pay up on – especially when that someone else has proven themselves to be serially unreliable. That makes the debt-money now sloshing around nothing more, really, than a slip of paper representing an untrustworthy promise.

To understand how untrustworthy the issuers are, you need look no further than the steady decline in purchasing power of all of the world’s many variations of debt-money. Case in point, in 1939 the average house cost $3,800.

Do you think that a shortage in real estate and improvements in construction quality explain the one hundred-fold increase in prices over the past 70 years? Not hardly. It’s that the Fed and other central bankers, in close cahoots with the politicians and their cozy buddies in high finance, have used the ludicrous and dishonest debt-money system to flood the nation with more and more of the stuff, debasing the existing stocks of same.

As we now know, because we can see it in the brazen numbers pushed forward by the president and Congress, the debt-money game is heading for a wall. It was one thing when the size of the debt rose at a measured pace that left it largely unnoticed as it grew and grew. But in 2009, the façade fell away, and now the severity of the problem is there for all to see.

While there have been some whiffs of a recovery in the economy, it is important to recognize that what recovery there is, is based on yet more debt-money. A lot more.

In other words, the roots of the recovery, as tentative as they may be, are exactly the same as the roots of the crisis."

How big are these debts?

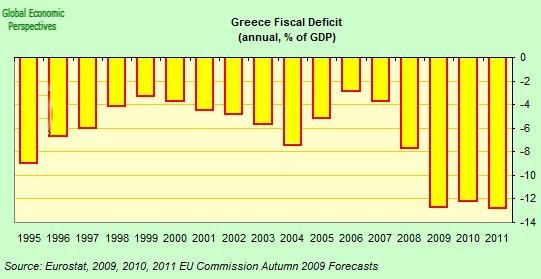

National debt, put at €300 billion ($413.6 billion), is bigger than the country's economy, [GNP] with some estimates predicting it will reach 120 percent of gross domestic product in 2010. The country's deficit -- how much more it spends than it takes in -- is 12.7 percent; What Greece is doing which means the revenue of the country for a whole year is not enough to pay off what they owe! This indicates the very real possibility of economic collapse.

Greece had borrowed heavily in the past 30 years. Public Debt as a % of GDP

Inability to collect Taxes and generate revenue: In a developed country of 11 million people, only around 15,000 individuals declare an annual income of over €100,000. Graft in Greece Future of Europe

Patronizing Policies: Previous inept Greek governments created patronizing policies that contributed excessive spending, causing the current economic crisis. Examples of such policies include:

allowing civil servants to retire in their 40’s

permitting their unmarried or divorced daughters to collect their pension after they have died

government-owned and hugely unprofitable Olympic Airways

government-owned and unprofitable utilities

hundreds of benefit programs and subsidies of every sort

enticing foreigners to retire and live in Greece without paying taxes and enjoy the low cost of living much as Greek citizens do

no effort was made to collect back taxes from the rich or embargo the secret foreign accounts of the bankers, corporate executives, ship owners, stock speculators, consultants, investment brokers who swindled Greek taxpayers and pensioners of billions of Euros.

no effort was made to recover the debts owned by the private sector to the state financial institutions." uncollected taxes

Cost of patronage in the public sector: In the month before the fall election, the government added 27,000 people to the public payroll. Many had no position to fill, and not even an office to go to, according to finance ministry officials but were on public salary. Graft in Greece

School system is notoriously bloated: The Economic Times reported on a Greek high school teacher who is “a strong supporter of Greece’s socialist government” but still going on strike with hundreds of thousands of other public sector workers next week to fight for “the 28,000-euro pension that he expects to receive annually after he turns 60 next year.” According to the teacher, “The worker can’t be the scapegoat. So we have to defend ourselves.” teacher pensions

Pension Fund: A 28,000-euro pension is about $38,000 per year—and it starts at age 60. Compare that to the U.S. So-So Security “pension program” that provides about $15,000 per year starting at age 65. It’s obvious that the U.S. can’t afford its So-So Security program much longer, so how can Greece afford a program that that’s more than twice as generous? It can’t. teacher pensions

Corruption in high places: In the end, the Greek crisis is not about too much debt, it’s about global fiat [ print money, without collateral, you don't really have ] currencies and the correlative corruption in high places. Where there’s fiat currency [ a form of fraud ], there’s corruption .... and inevitably treason. teacher pensions

Corruption undermines public finances in myriad ways. Cheating the government, especially on taxes, is widespread. Government-procurement bribery and political patronage bloat government spending. And pervasive petty bribery erodes the state's authority over taxpayers. They call you stupid if you comply with the regulations. Graft in Greece

These are just a few examples of government gone wrong.

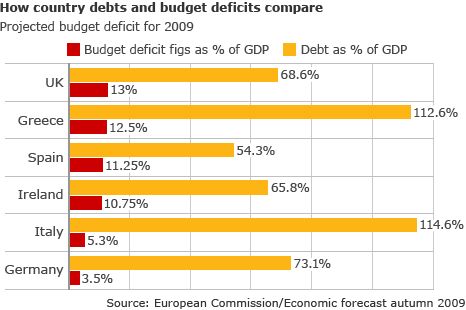

The same has gone on in most nations, and especially Italy, Portugal, Spain, Japan, Ireland, the UK, and of course the United States. Not a single citizen in any of the beleaguered nations with debts to the sky, voted for these debts. Greece and Goldman Sachs

The same has gone on in most nations, and especially Italy, Portugal, Spain, Japan, Ireland, the UK, and of course the United States. Not a single citizen in any of the beleaguered nations with debts to the sky, voted for these debts. Greece and Goldman Sachs

But once all these ‘programs’ and bailouts are in place, it has been virtually impossible to ever get rid of them, at least not without riots, strikes, and violence, which is what is happening right now in Greece. Withdrawal and expulsion from the EU

| Real problem with the Greek Economy: The 2010 financial problems of the Greeks were instigated by the American banks selling worthless Credit Default Swaps [CDS] as an unsecured paper debt contract

[no backup collateral]; really worthless junk bonds to Greece and the rest of the world! This is a fact that no one wants to admit! Previous Greek governments spent money they did not have. For over 30 years they then borrowed money without any real collateral. Debt piled up on more debt! To make things worse, Greece has not had real basic income; inept in collecting income tax! Their national debt is bigger than their GNP and this is an automatic symptom for disaster. They tried cutting programs and bailouts, but that has resulted in civil unrest. The IMF loaned some money, as did other foolish national treasuries, so Greece had been saved...for a short time. It is doubtful that Greece can ever pay back the loans. Any Euros it borrows will command huge interest rates, because Greece's credit rating has been reduced to “Junk bonds." Bloomberg: Standard-Poors devalues Greece Goldman Sachs handshake with Greece: "Greece has been plagued by corruption and backdoor arrangements between friends. It seems clear today that Goldman Sachs, through the use complex arrangements (swaps) and credit derivatives, enabled the Greek government to reduce its national debt by more than 2 billion Euros by means of an invisible loan. This practice allowed Greece to enter the Euro zone. There is also evidence that the successive governments since 2001 decided to look the other way on this issue." Goldman Sachs

The USA Senate grilled Goldman Sachs big shots, and never did get a good answer to their questions. They did a perfectly ‘legal;’ thing, and that was to sell junk bonds to the unwary, shallow, vote hungry politicians, and then short on the deal, and make a lot of money. Did Goldman make a lot of commissions helping Greece get into trouble? Did they profit hugely from the shorts after selling the instruments? Of course, and it was perfectly “legal.” Did any citizen or group of citizens vote for it? Of course not! Who will pay? One political answer is, MORE TAXES! Greece and Goldman Sachs So what is Greece doing? Bailout Request: International Monetary Fund [ IMF ] funded by United States, approved, on March 10, 2010, an unsecured three-year €30 billion ($39 billion) contribution to a €110 billion Greek rescue package. IMF approves bailout | EURO funding The Greek government has also started slashing away at spending and has implemented austerity measures aimed at reducing the deficit by more than €10 billion ($13.7 billion). It has hiked taxes on fuel, tobacco and alcohol, raised the retirement age by two years, imposed public sector pay cuts and applied tough new tax evasion regulations. What Greece is doing While not an industrial country, and therefore not heavily relying on exports, Greece does rely on revenue from international services, such as shipping and tourism, which have historically been called "Greece's industry". With consumers cutting back on non essentials, tourism will undoubtedly take a hit and if business conditions remain weak, so will shipping. Summary: Thus, the Greek problem is not simply caused by incompetence or mismanagement—it’s caused by fraud, corruption and the kinds “crimes in high places” that would be almost unknown without the rigged, government bookkeeping systems that fiat [ printing money as new source of funding without backup ] currency makes possible. This is called "white crime!" How is the bailout going to work? The $1 trillion bailout program transfers this government debt onto the taxpayers of the larger, more solvent states [ countries ]. Europe's debt is in the public sector. The problem with Europe is that some of the peripheral states [ PIIGS ] can't keep up with the interest on the money they borrowed. [ Reason: Once government debt levels approach 100% of GDP, things can get tricky. That's because a lot of a country's income from taxes and other sources has to be spent on interest payments. It becomes harder to pay off the loan premiums and balance the budget. The pay-off is not sustainable!] Greece, for example, was scheduled to have debt equal to 150% of GDP by 2011. Even at 5% interest, it would take GDP growth of 7.5% per year just to keep up with the interest payments. Since growth in Greece is not expected to come in anywhere near 7.5%, and will probably even be negative, it will sink further into debt. You can’t really cure a debt problem with more debt. Adding more to the Greek problem is the devaluation of Greece’s credit rating by Standard & Poor’s on April 27, 2010 to junk, making it the first Euro member to lose its investment grade. Bloomberg: Standatd-Poors devalues Greece Europe is putting good money behind bad money. Bonner: Good money after bad The problem in Greece is similar to that of Latvia: "Latvia in 2008 was hit by a financial crisis in which its currency came under speculative attack. But since Latvia--like Greece in 2001--was determined to hold its exchange rate steady in order to be admitted to the euro zone, policy makers rejected the advice that they devalue. Instead, the Latvians slashed wages and government spending by 10 to 20% and deliberately engineered a deep recession in the hopes of getting their budget deficit down to the prescribed levels for euro zone entry. While Latvia has succeeded in holding its exchange rate steady, the ensuing recession has been the deepest in the European Union. In 2009 the Latvian economy contracted by 18% and unemployment rose to 20%. This is the kind of calamity that may be awaiting the Greeks, where unemployment is already 11.3%, a six-year high." Greece and Latvia example A mystery bailout: The bailout plan is a mystery on a mystery

with CDS bonds. No one really knows who has the IOU or who pays for what! Greece cannot devalue its currency because it is controlled by EURO and not Greece. Bloomberg: Standatd-Poors devalues Greece References: Adask Alfred. "The Greek Crisis: When Thieves Fall Out," Adask's Law, February 16, 2010. teacher pensions Applebaum Anne, "The Future Is Greek," Slate, Feb. 16, 2010. Greek crisis similar to USA Take a good look at the Greek financial crisis. America could soon face something very similar. Athanassiou

Phoebus, "Withdrawal and expulsion from the EU and EMU some reflections,"

, LEGAL

WORKING PAPER SERIES NO 10

/ DECEMBER 2009,

European Central Bank. Withdrawal

and expulsion from the EU

Abstract: This paper examines the issues of secession and expulsion from the European Union (EU) and Economic and Monetary Union (EMU). It concludes that negotiated withdrawal from the EU would not be legally impossible even prior to the ratification of the Lisbon Treaty, and that unilateral withdrawal would undoubtedly be legally controversial; that, while permissible, a recently enacted exit clause is, prima facie, not in harmony with the rationale of the European unification project and is otherwise problematic, mainly from a legal perspective; that a Member State’s exit from EMU, without a parallel withdrawal from the EU, would be legally inconceivable; and that, while perhaps feasible through indirect means, a Member State’s expulsion from the EU or EMU, would be legally next to impossible. This paper concludes with a reminder that while, institutionally, a Member State’s membership of the euro area would not survive the discontinuation of its membership of the EU, the same need not be true of the former Member State’s use of the euro. Barr Alistair, "The second debt storm," The Market Watch, May 14, 2010.

Second

debt storm

"the cost of insuring against sovereign default in Western Europe has climbed further, hitting a record of 169 basis points on May 7. The European bailout pushed that down to 120 basis points on Tuesday. But that's still more expensive than default protection on North American corporate debt which cost 100 basis points on Tuesday. (In the credit derivatives market, 100 basis points means it costs $100,000 a year to buy default protection on $10 million of debt for five years)." Bonner Bill, "Good money after bad," The Daily Reckoning., May 14, 2010. Bonner: Good money after bad Casey Doug, "Debt money," Casey Research, February 05, 2010: Casey World debt crisis Casey Doug, "Facts or fiction, Casey's Daily Dispatch, May 18,

2010. Debt vs GNP

CNN, "Q&A: Greece's financial crisis explained, CNN News, March 26,

2010. What Greece is doing Daley Suzanne," Greek corruption is everywhere but tax forms," The New York Times, May 1, 2010. Corruption everywhere Davis Bob ,"IMF Approves Greek Bailout, Urges Against Debt Default," The Wall Street Journal, May 9, 2010. IMF approves bailout A restructuring of Greek debt won't ease Greece's economic woes, said the International Monetary Fund's No. 2 official, as the IMF approved its three-year €30 billion ($39 billion) contribution to a €110 billion Greek rescue package. Hugh Edward, "Few surprises as Greece's economic contraction accelerates," February 14, 2010. IMF Deputy Managing Director John Lipsky said that a debt default by Greece followed by a restructuring, as urged by many investors over the past week, "would be a recipe for significant disorder." Firelle Charles and Stephen Fidler, "Europe's Original Sin," The Wall Street Journal, March 3, 2010. EURO ignored Greece Franchet Pascal, "The Corrupt Practices of Financial Manipulation: The Meaning of the Greek Economic Crisis," Global Research, April 3, 2010. Greek corruption Greece is not the only country in the euro area that has borrowed stealthily: Table 1: Public Debt as a % of GDP: 2007 2008 2009* 2010** Growth

after 2007 Austria 59.4 62.5 70.4 75.2 26.6 Belgium 84 89.6 95.7 100.9 20.1 Finland 33.4 39.7 45.7 36.8 France 63.8 68 75.2 81.5 27.7 Germany 65.1 65.9 73.4 78.7 20.9 Greece 94.8 97.6 103.4 115 21.3 Ireland 25 43.2 61.2 79.7 218.8 Italy 103.5 105.8 113 116 12.2 Netherlands 45.6 58.2 57 63.1 38.4 Portugal 63.5 66.4 75.4 81.5 28.3 Spain 36.2 39.5 50.8 62.3 72.1 Euro

Zone 66 69.3 77.7 83.6 26.0 *Estimation; ** Prevision; Source: Eurostat Note: For Finland, the rate of growth is calculated on the base of the year 2008 Grey Barry, "Sovereign Debt Fears Signal New Stage of Global Crisis," Global Research, February 6, 2010. Fears Global Crisis IMF: The European Union agreed to a €720 billion bailout plan in an effort to stanch a burgeoning sovereign-debt crisis that began in Greece but now threatens the stability of financial markets worldwide. The money would be available to rescue Eurozone economies that get into financial troubles, the diplomats said. The plan would consist of €440 billion of loans from Eurozone governments, €60 billion from an EU emergency fund, and €220 billion from the International Monetary Fund. Now… That’s a LARGE bailout! I don’t know if you noticed or not, so I’ll make a point of the number and who it came from… €220 billion from the International Monetary Fund. That’s the IMF, folks… Do you know who funds the majority of the IMF? Yes… That’s the US. EURO funding Kunstler James Howard, "The European Bailout Absurdity: Money for

Nothing," The Daily Reckoning, May 11, 2010. The European Bailout Absurdity: Money for Nothing Neuger James, "Euro Breakup Talk Increases as Germany Loses Proxy (Update1)," Bloomberg.com, May 14, 2010. Bloomberg: Standatd-Poors devalues Greece Greece’s credit rating was cut to junk by Standard & Poor’s on April 27, making it the first euro member to lose its investment grade. "expecting the Greek ship of state to capsize and possibly take the concept of the eurozone along with it." EURO is impossible to manage: "Today’s euro is far from what economists like Nobel laureate Robert Mundell call an “optimum currency area.” Gross domestic product per person ranges from 69,300 euros in Luxembourg to 18,100 euros in Slovakia, debt from 14.5 percent of GDP in Luxembourg to 115.8 percent in Italy, and unemployment from 4.1 percent in the Netherlands to 19.1 percent in Spain." Pagano Marco, "Fiscal crisis, contagion and the future of

Europe," VOXEU, May 15, 2010.

Future of Europe

Park Danielle, "The plain and complex truth," Financial Sense University, May 3, 2010. inancial Truth Petras James, "Greece: The Curse of Three Generations of Papandreous," Global Research, March 22, 2010. uncollected taxes Smith Helena, "Greek profligacy, pensions and perks cost nation dear," Guardian Co. UK, May 7, 2010. Perks and pensions Stott Don, "Greece and Goldman Sachs," Whiskey & Gunpowder, May 7, 2010. Greece and Goldman Sachs Walker Markus, "Tragic Flaw: Graft Feeds Greek Crisis," The Wall Street Journal, APRIL 15, 2010. &bnsp; Graft in Greece Alkman Granitsas contributed to this article Wikipedia, "Greece," Greece background The Greek economy is a developed economy with the 22nd highest standard of living in the world.[5] The public sector accounts for about 40% of GDP. The service sector contributes 75.8% of the total GDP, industry 20.8% and agriculture 3.4%. Greece is the twenty-fourth most globalized country in the world and is classified as a high income economy. Greece's main industries are tourism, shipping, industrial products, food and tobacco processing, textiles, chemicals, metal products, mining and petroleum. Greece's GDP growth has also, as an average, since the early 1990s been higher than the EU average. However, the Greek economy also faces significant problems, including rising unemployment levels, inefficient bureaucracy, tax evasion and corruption. Greece attracts more than 16 million tourists each year, thus contributing 15% to the nation's Gross Domestic Product. In 2008, the country welcomed over 16.5 million tourists. The number of jobs directly or indirectly related to the tourism sector were 659,719 and represented 16.5% of the country's total employment for 2004. In 2007, the average worker made around 20 dollars per hour, similar to Spain and slightly more than half of average U.S. hourly income. Immigrants make up nearly one-fifth of the work force, occupied mainly in agricultural a construction work. Greece's purchasing power-adjusted GDP per capita is the world's 26th highest. According to the International Monetary Fund it has an estimated average per capita income of $30,661 for the year 2008,[36] a figure comparable to that of Germany, France or Italy. Wood Barry, "Greece and the Euro: Recession with no exit," The

Huntington Post, May 15, 2010. Greece

and Latvia example

|

Economic Dominoes: "Greece's weaknesses are also shared by the United States as well as Spain, Italy, Ireland, Portugal and England.

Economic Dominoes: "Greece's weaknesses are also shared by the United States as well as Spain, Italy, Ireland, Portugal and England.  Though United States does not have precisely the same problems, we do have a similar level of political paralysis and a similar level of partisanship. It has not been possible to reform U.S. Social Security: President Bush tried halfheartedly and gave up before he started. It may not be possible to reform health care, either: Hillary Clinton failed, and President Obama, despite throwing in expensive sweeteners, may well fail. The influence of lobbyists cannot be reduced or controlled. The power of interest groups to influence legislation cannot be tamed. We might not have farmers squatting on state land, but we do have farmers dependent on huge, distorting agricultural subsidies that apparently cannot be reduced."

Though United States does not have precisely the same problems, we do have a similar level of political paralysis and a similar level of partisanship. It has not been possible to reform U.S. Social Security: President Bush tried halfheartedly and gave up before he started. It may not be possible to reform health care, either: Hillary Clinton failed, and President Obama, despite throwing in expensive sweeteners, may well fail. The influence of lobbyists cannot be reduced or controlled. The power of interest groups to influence legislation cannot be tamed. We might not have farmers squatting on state land, but we do have farmers dependent on huge, distorting agricultural subsidies that apparently cannot be reduced."