By Walter Sorochan, Emeritus Professor, San Diego State University

Posted March 18, 2009; Updated December 19, 2014; Disclaimer

| The economic meltdown was not an accident or unforeseen event. Not only were there early warning signs, but much of the meltdown was orchestrated both inadvertently and with the selfish motivation for greed and money. Many members of Congress contributed to the economic meltdown by accepting vested interest campaign funds that encumbered them to do the bidding of wallstreet and corporations; now these same congressmen are spinning their improprieties. |

Purpose of article: To briefly and simply illustrate the events that lead to the real estate meltdown, Wall Street collapse and global financial depression.

New threat to Global Economy: Greece and PIIGS

How the bankers, lenders, loan companies, insurance companies, wall street and speculators made money at the expense of a naïve public.

By understanding the causes of the many meltdowns, we can reverse engineer the causes and fix the continuing economic problems.

Step 1 Early symptoms ignored: One of the earliest signs that the economic system had flaws was the mid-1970's shortage of oil. There was no long range energy plan! Then there were several mini-stock market crashes thereafter. All these forecasters of the future were ignored! "Business as usual!"

Step 2 Credit default Swaps: A financial instrument Credit Default Swaps [ CDS or SWAPS ], was created by Blythe Masters of JPMorgan Chase Bank in the early 1980s. [ Teather ] This instrument developed the credit derivatives which were at the heart of the current financial crisis. It exchanged or swapped paper debt for collateral.

In 1997, Masters and her team developed many of the credit derivatives that were intended to remove risk from companies' balance sheets. The idea was to separate the default risk on loans from the loans themselves. The banks argued that by trading credit derivatives of the kind pioneered by Masters, they had spread their risk elsewhere and therefore needed lower reserves to protect against loan defaults. Regulators rolled over and the banks loaned ever more. It was a huge success and the market for credit derivatives grew rapidly.

The new instrument, the Credit

Default Swap [ CDS ] was used as an insurance to secure paper

notes or loans. SWAPS set the stage for a new form of gamble

speculation. It allowed banks and big insurance corporations to

make money by not assuming responsibility to have enough

collateral or cash on hand to cover their bets.

The

economic mess the entire world finds itself in 2009 started a long

time ago; probably 300 years ago with the free enterprise system.

But it started surfacing in 2001 when banks began using a special

way of providing collateral for money they were borrowing from

investment banks and others. Enron, the energy giant in 2000, exploited

special credit notes, called Credit Default Swap, to create a paper

money empire [ without cash reserves to back up the SWAPS trading

] that collapsed in 2002.

Step

3 Enron 1980s: Enron, the defunct energy

corporation in Houston, Texas., evolved its own form of an unregulated

banking and loan system. Enron borrowed the idea of a new instrument

from JPMorgan Chase Bank in the early 1980s; that exchanged or

swapped paper debt for collateral. The new instrument was called

the Credit Default Swap [ CDS or SWAPS ] and was used as an

insurance to secure paper notes or loans and also generate income

for Enron. Politicians in Washington bent over backwards to

accommodate Enron.

Enron exploited special credit notes,

called Credit Default Swap, to create a paper money empire that

collapsed in 2002. Enron triggered Wall Street speculation that

brought the financial institutions down in 2009.

The

tragedy of Enron is that no one did anything about preventing the

Enron tragedy from reoccurring! For more information click on:

Enron

Step 4 1980 - 2000 Speculative gambling on the stock market started big time in the late 1980’s with Enron. No one understood CDS in the 1980 - 1990's era. Congress gave Enron political and fiscal freedom to use CDS as they wished, without monitoring, accountability or regulation. After all, Wall Street and free enterprise would work to provide an equal playing field for everyone!

CDS opened the door to all future events such as creating sub-prime loans, allowing unsecured securities to be sold by banks, and disposing of unmonitored CDS to foreign investors. Everyone who participated in the "CDS gambling table" had dollar signs in their eyes and greed and power in their hearts. Politicians had a "hands off" policy toward all these shenanigans.

Step

5 Gramm's Commodity Futures Modernization Act of

2000 in the dark of night:

Credit

Default Swaps became exempt from regulation with the Commodity Futures

Modernization Act of 2000, which was also responsible for the Enron

loophole. U.S. Sen. Phil Gramm (R-TX) introduced the Act on behalf

of financial industry lobbyists. The Modernization Act was rushed

through Congress as a companion bill to the omnibus spending bill,

the last day before the Christmas holiday at 2:00am in the morning

when the senate was empty. Not a single politician read the bill.

Most did not know what was in the bill.

Credit

Default Swaps became exempt from regulation with the Commodity Futures

Modernization Act of 2000, which was also responsible for the Enron

loophole. U.S. Sen. Phil Gramm (R-TX) introduced the Act on behalf

of financial industry lobbyists. The Modernization Act was rushed

through Congress as a companion bill to the omnibus spending bill,

the last day before the Christmas holiday at 2:00am in the morning

when the senate was empty. Not a single politician read the bill.

Most did not know what was in the bill.

The "Commodity Futures Modernization Act of 2000" (H.R. 5660) was introduced in the House on December 14, 2000 by Rep. Thomas W. Ewing (R-IL) and cosponsored by Rep. Thomas J. Bliley, Jr. (R-VA) Rep. Larry Combest (R-TX) Rep. John J. LaFalce (D-NY) Rep. Jim Leach (R-IA) and never debated in the House.[2] The companion bill (S.3283) was introduced

in the Senate on December 15, 2000 (The last day

before Christmas holiday) by Sen. Richard Lugar

(R-IN) and cosponsored by Sen. Peter Fitzgerald

(R-IL) Sen. Phil Gramm (R-TX) Sen. Chuck Hagel (R-NE)

Sen. Thomas Harkin (D-IA) Sen. Tim Johnson (D-SD)

and never debated in the Senate. |

The bill by-passed the substantive policy committees in both the House and the Senate so that there were neither hearings nor opportunities for recorded committee votes. The omnibus spending bill, which was 11,000 pages long, is the financial plan the government requires for everyday operations. President Clinton signed the bill into Public Law (106-554) on December 21, 2000. This bill spurred the loaning of easy to get loans to home buyers.

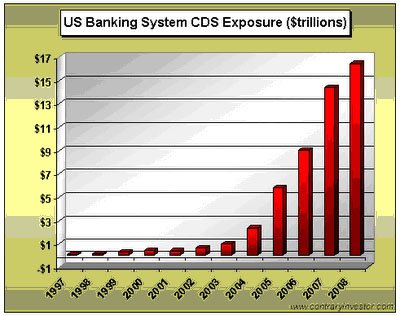

The Modernization Act allowed for even more regulatory bypasses. It became difficult to determine the financial strength of the sellers of protection. CDS came to be issued for Structured Investment Vehicles, which did not have a known entity to follow to determine the strength of a particular bond or loan. The market became rampant with gambling as sellers and buyers of CDS were no longer owners of the underlying asset (bond or loan). Before the Act of 2000, the CDS markets value was 900 billion. By the end of 2007, the CDS market had a notional value of $45 trillion.

Step 6 The real estate boom: Mainstreet was ready to take part in the SWAPS casino. Common folk wanted to live the American dream of owning a home. And banks and loan companies were eager to help them.

"I have a dream ..." "Whooow! No money down!"

Step 7 Prospective Buyers - a Big Housing Market:

Quick Loan

Funding targeted people who couldn't afford a down payment and had

poor credit... so-called "sub-prime borrowers." Mortgage lender Daniel

Sadek, head of Quick Loan Funding, drastically reduced borrowers'

credit requirements and may have raked in as much as $5 million a

month in personal profits.

Quick Loan

Funding targeted people who couldn't afford a down payment and had

poor credit... so-called "sub-prime borrowers." Mortgage lender Daniel

Sadek, head of Quick Loan Funding, drastically reduced borrowers'

credit requirements and may have raked in as much as $5 million a

month in personal profits.

After cranking out thousands

of sub-prime mortgages, credit began to dry up and Quick Loan

eventually closed. But the momentum toward easy loans had a

jump-start!

Step

8 Sub-prime loans & more new owners:

With

rising home values, almost everyone believed they could get rich

just by buying a home.

With

rising home values, almost everyone believed they could get rich

just by buying a home.

And pretty much

everyone -- even those with terrible credit histories -- could get

a home loan. This was the beginning of " sub-prime loan!"

And pretty much

everyone -- even those with terrible credit histories -- could get

a home loan. This was the beginning of " sub-prime loan!"

Buyers were persons who could not afford to buy & who did not have a moderate down payment. Mainstreet usually bought houses with an adjustable rate mortgage.

A new loan was created: “the pay option negative amortization

adjustable rate mortgage.” It was designed to help first-time

homebuyers who couldn’t actually afford the cost of the loan.

Those homebuyers would have the option to pay only part of the

interest they owed each month. The unpaid interest was added to

the total amount of the mortgage. As a result, the mortgage

balance increased; instead of the mortgage being paid down, it was

getting bigger.

A new loan was created: “the pay option negative amortization

adjustable rate mortgage.” It was designed to help first-time

homebuyers who couldn’t actually afford the cost of the loan.

Those homebuyers would have the option to pay only part of the

interest they owed each month. The unpaid interest was added to

the total amount of the mortgage. As a result, the mortgage

balance increased; instead of the mortgage being paid down, it was

getting bigger.

Key motivation for lenders was earning

more commission sales.

Step 9

Another loan customer: more refinancing by

encouraging small Equity Loans:

Owners who bought homes at beginning of the boom earned an equity as home prices rose.

Owners who bought homes at beginning of the boom earned an equity as home prices rose.

These owners refinanced their homes & used the extra cash for

home improvements & other purchases. Their loan terms were

risky!

These owners refinanced their homes & used the extra cash for

home improvements & other purchases. Their loan terms were

risky!

Bill Dallas started a new company, Ownit, and

offered to sell Wall Street a mortgage for borrowers who weren't

quite "prime." It was a 100% home loan for people with good credit

who couldn't afford a down payment that featured:

|

Arturo Trevilla bought a house with an adjustable rate mortgage. He planned to refinance his mortgage before the payments went up. The idea seemed simple, but the paperwork was tricky. Arturo says “it was hard for me to understand…I just trusted a broker.” But with a salary of $900 a week he knowingly signed documents claiming he made four times as much….and bought a $584 thousand dollar San Clemente, Ca., townhouse. Trevilla eventually lost his home to foreclosure. [ house of cards ] |

In 2004 homeowners

withdrew an estimated $900 billion dollars by refinancing and spent

the money on whatever they could buy. Homes had turned into ATM

machines and the economy flourished.

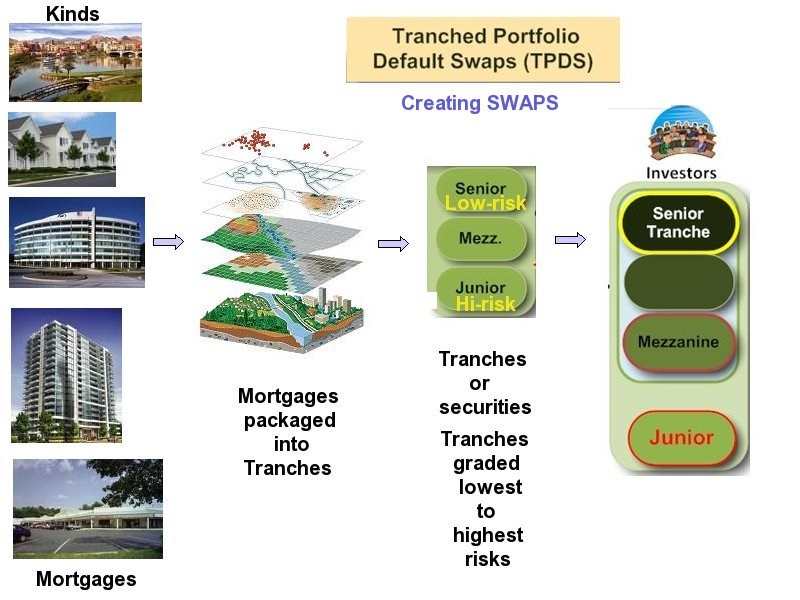

Step 10

![]() Tranches --

Restructured Loans made available from Wall Street:

Tranches --

Restructured Loans made available from Wall Street:

Lenders were more than happy to issue mortgages and Wall Street was more than happy to have a new supply of mortgages to package up and sell to hungry investors around the world. It seemed everyone was spending…and making money.

But, just like many homeowners, a lot of investors didn't

quite understand what kind of mortgages they were buying. Major

Wall Street banks enlisted lenders to supply them with mortgages

banks could sell to investors. Banks eagerly dropped many

requirements for the mortgages they were willing to sell: "removing the

litmus test ... No income, no asset. Not verifying income...

breathe on a mirror and if there's fog you sort of get a loan."

Wall Street bankers pooled together thousands of these

mortgages, carved them up into similar packages and profitably

sold them as securities.

Credit tranching refers to

creating multiple classes (or "tranches") of securities, each of

which has a different seniority and value relative to the others.

[ more info on tranches ]

Step

11 Rating Agencies During the boom, when

home prices surged and virtually no borrowers defaulted, the

riskier Triple-B rated securities made from mortgages looked as

good as the safe Triple-A's. "Eventually the market gets smart and

says, let's lower the requirements for Triple-A."

The key to getting investors to buy those mortgage-backed securities was to get them stamped with a seal of "respectable grade" approval. Big institutions like police retirement funds and universities would only invest if the investment rating agencies — Moody’s, Standard & Poor’s, and Fitch — gave the securities an “investment grade” rating. “Investment grade” can range from the safest triple A-rated investments to the lower triple B-rated investments. Because a triple A security is safer, it pays less than a riskier triple B. credit rating

The credit rating agencies had an incentive

to award a security the best possible ratings; agencies were paid

for their appraisals by the very banks that issued the securities.

[ Moody loan ratings fiasco ]

Step

12 CDOs – Collateralized Debt Obligations:

A CDO is an arrangement that raises money primarily by issuing its own bonds and then invests the proceeds in a portfolio of bonds, loans, or similar assets.

These structured products are highly complicated investments. The debt securities are bundled and re-sold but often buyers don't really know exactly what they are purchasing. Even Alan Greenspan admitted he was befuddled by the CDO. Hence, these have be referred to as "toxic waste." [toxic waste]

CDOs are constructed from a portfolio of fixed-income assets. CDOs are divided by the issuer into different tranches: senior tranches ( rated AAA), mezzanine tranches (AA to BB), and equity tranches (unrated).

For a simple explaination

of how CDO work, [ refer to Gagliano

and Hirsch: “ …. CDO is an investment that works kind of like a

champagne bottle." ]

Step

13 CDOs and CDS are different financial

cousins: CDO's [ a form of debt-security bond ] were purchased by

investors who were told by "creditable" ratings agencies that these

securities were "investment grade. Some of these investors obviously

didn't believe the credit agencies and decided to seek insurance

in the case that their CDO defaulted. They bought insurance

protection in the form of credit Default Swaps or CDS [ often

referred to a "swaps" ] so as to insure their investment. Credit

default swaps are bought by bond holders to hedge or bet against

the default risk of banks.

Credit Default Swap is basically an insurance policy against the failure of CPO's'. Companies - like AIG, Lehman and Fortis (and many others) found these insurance policies to be a very lucrative business. The problem is that AIG didn't foresee that any of these would default - they thought this was a risk free operation. AIG took in a ton of money to insure the CDO's through Credit Default Swaps - but never had enough reserved for losses. When numerous CPO's defaulted and their investors put a call to be compensated, AIG did not have the money in reserves to do so. Hence AIG declared bankruptcy and had to be bailed out; on assumption that "it was too big to fail!"

Step 14 Fishy odor on Wall Street & Hedge Funds: Credit default swaps were bought by bond holders to hedge or bet against the default risk of banks.

Alert signals were sounded in early 2000's by wall street players like Steve Eisen, Meredith Whitney, Timothy Sykes and Kyle Bass [ Pittman ] that sub-prime lending practices in the housing industry were corrupt and doomed to failure. No one, but no one listened to them! By the spring of 2005, Steve Eisen at FrontPoint, and others, were fairly convinced that something was very screwed up not merely in a handful of companies but in the financial underpinnings of the entire U.S. mortgage market. Eisen refined a betting instrument called hedge fund; which basically bets that a holder [bank lender] of a loan or CDS will not be able to repay the loan in a specific period of time.

Hedge fund speculators began using hedge funds to profit from an anticipated housing meltdown. [ hedge funds, Lewis ] Hedge funds invested in "credit protection," a kind of insurance on various mortgage-backed securities. As those securities decline in value, hedge fund insurance paids off. Kyle Bass' hedge fund made more than a billion dollars in profit.

Step 15

Banks solvency requirements:

Banks [ and insurance corporations like AIG ] need a certain

amount of cash on hand to be solvent and be able to cover their

banking obligations. Many banks in 2000 to 2009 had capital ratios

below the required 10 % liquidity requirement. This allowed them

to pay the SWAPS game and speculate on investing in busted market

for mortgages, derivatives and especially credit default swaps; an

unsecured paper debt. [ Bank Capital

Requirement ]

Banks [ and insurance corporations like AIG ] need a certain

amount of cash on hand to be solvent and be able to cover their

banking obligations. Many banks in 2000 to 2009 had capital ratios

below the required 10 % liquidity requirement. This allowed them

to pay the SWAPS game and speculate on investing in busted market

for mortgages, derivatives and especially credit default swaps; an

unsecured paper debt. [ Bank Capital

Requirement ]

The big lending banks, like JPMorgan Chase, Bear stearns, Wachovia, HSBC, Bank of America, CityGroup, PNC Bank, Lehman Brothers, Suntrust Bank and State Street Bank got into trouble when they made big loans and could not pay off to creditors or when a creditor made a "call" on the bank. Unable to pay off their creditors, they had to declare bankruptcy and ask for a government bailout or sell.

Also involved in this bank gambling fiasco were the big bank insurers like AIG. These firms also created similar financial distresses for themselves.

Step

16 Marketing SWAPS:

Wall Street sold CDO's and CDS's to greedy speculators who wanted

to make money.

Wall Street sold CDO's and CDS's to greedy speculators who wanted

to make money.

The business of wall street banker Michael Francis was to pool mortgages and sell them to investors who would then get the monthly payments those mortgages produced. The more mortgages lenders provided to homebuyers, the more “product” Francis would have to sell.

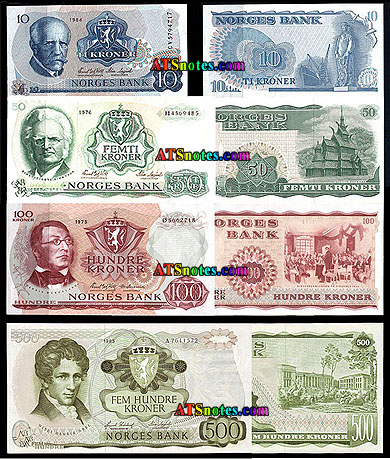

Step 17 Speculator buyers worldwide:

Example of foreign investor-speculators:

| Britain | France | Fiji | Norway | China |

|

|

|

|

|

Step 18

The Housing Bubble bursts

... the beginning of the economic meltdown. The housing bubble

bursts, spreading like a domino effect to the other money

institutions. CDOs were packaged into baskets securities and sold

worldwide.

... the beginning of the economic meltdown. The housing bubble

bursts, spreading like a domino effect to the other money

institutions. CDOs were packaged into baskets securities and sold

worldwide.

Example Narvik, Norway: town far above the

Arctic Circle that was convinced it could solve its budget

problems by investing in Wall Street's wares... primarily CDOs. In

spite of not understanding what it was that they were buying, Town

leaders thought it was a safe investment.

But the

investment collapsed. Now, the town has closed a school and

slashed services for the elderly.

Step

19 Toxic Poison Today:

Non-liquid

mortgage assets that have lost value. The Fed thinks that some

securities are worth just five cents on the dollar. How big is

the problem? In most cases no one knows where these CDS derivative

assets are, what kind these are nor how many there are. The federal

government was asleep by removing speculation controls and not

monitoring CDS. Not being able to identify these toxins is what has

disabled us in dealing with this economic mess.

Non-liquid

mortgage assets that have lost value. The Fed thinks that some

securities are worth just five cents on the dollar. How big is

the problem? In most cases no one knows where these CDS derivative

assets are, what kind these are nor how many there are. The federal

government was asleep by removing speculation controls and not

monitoring CDS. Not being able to identify these toxins is what has

disabled us in dealing with this economic mess.

Furthermore, SWAPS have been unregulated, sold worldwide; thus difficult to find. [ Toxic Debt ]

Especially alarming is the large growth in credit default swaps in the US Banking system. This chart from contrary investor shows only $16 trillion in exposure, while it is generally estimated (no one really knows) that there are some $60 trillion outstanding worldwide.

| Conclusion:

Fixing the economic problems requires that we:

Create jobs for mainstreet folks Rethink & revap the capitalistic system reverse engineer to fix the continuing problems |

Why bailouts may not work:

1. Because Washington serves corporate America and no longer the

American people. We need to free Washington politicians from

drinking from the corporate cup![ e.g. lobbyists as in image on right].

Lobbyists and campaign funds are buying a lot of favoritism and

cover-up in Congress and the senate. We need to control lobbying,

campaign funding and corporate influence in Washington. For

information about campaign contributions from banking, wall

street, insurance companies and other sources, refer to

following: Fixing

US Economy

Senator Dodd

Fanny Mae & Freddie

Barney Frank

1. Because Washington serves corporate America and no longer the

American people. We need to free Washington politicians from

drinking from the corporate cup![ e.g. lobbyists as in image on right].

Lobbyists and campaign funds are buying a lot of favoritism and

cover-up in Congress and the senate. We need to control lobbying,

campaign funding and corporate influence in Washington. For

information about campaign contributions from banking, wall

street, insurance companies and other sources, refer to

following: Fixing

US Economy

Senator Dodd

Fanny Mae & Freddie

Barney Frank

2. Toxic debt festers: as long as the financial wound is infected with SWAPS, the toxic debt will continue to fester. We need to clean the germs [ CPO, CDS ] causing the toxins [ unsecured bad paper debt ]; otherwise the infection can cause gangerine . We need to stop the infection [ economic meltdown ] from becoming a gangerine [ economic depression ] and then the patient [ economy ] will heal quickly!

3. Bailouts are ambiguous & have no accountability. To get more detailed information go to: CNNmoney for total bailout spending

Bailout efforts were designed to stimulate the economy, avoid a housing bust, restore public confidence, contain the credit crunch, reduce the danger of a global debt collapse, and shore up sinking banks. There is no evidence that all these efforts are working! Indeed, President Obama is trying to restore confidence in the banking, loan and insurance system as a way of rebuilding confidence in the capitalistic system. Instead, he should be passing solid legislation to regulate wall street and the policies that lead to outsourcing jobs, gambling on wall street and fix the broken federal bank and printing of money.

4. Not identifying the real problem(s):

Bush Administration panicked and gave $700 billion Troubled Asset Relief Program (TARP) in the fall, 2008 in hopes of resolving the banking meltdown. This was a shotgun approach in hopes of killing whatever was causing the meltdown. Bush attacked the symptoms and not the cause of the problem [ lack of regulations on speculation on wall street ]. Bush, fall of 2008 declared war on debt crisis

Furthermore, the economic problems are bigger than just the banking industry. For example:

e.g.: Publicly-traded companies losing their AAA credit ratings Standard & Poor's downgraded General Electric on March 12. Then, later the same day, Fitch took Berkshire Hathaway down a notch, too. That leaves just five companies with AAA ratings: Automatic Data Processing, Exxon Mobil, Johnson & Johnson, Microsoft, and Pfizer as of March 17, 2009. American's strongest companies are hurting!

e.g.: Corporate bankruptcies: A chain reaction of Chapter 11 filings or federal takeovers, including not only General Motors and Chrysler, but also Ann Taylor, Best Buy, Jet Blue, Macy's, Saks Fifth Avenue, Sears, Toys "R" Us, U.S. Airways and even giants like Ford or General Electric.

e.g.: Nationwide epidemic of small and medium-sized bank failures: Outright FDIC takeovers, with little prospect of nationalization. Over 100 small banks have recently defaulted and taken over by FDIC.

e.g.: Insurance failures: State takeovers of companies like Ambac Assurance, Bankers Life and Casualty, Conseco, FGIC, Medical Liability Mutual, Mortgage Guaranty Insurance, Nuclear Electric Insurance, PMI Mortgage, Standard Life of Indiana and many others.

e.g.: Cities and states: An epidemic of defaults by thousands of cities, states and other issuers of tax-exempt municipal bonds.

e.g.: Stock market shutdowns: Trading halts on major, big-cap stocks ... plus on-again, off-again exchange shutdowns, making it increasingly difficult for investors to liquidate their holdings at any price.

e.g.: Credit market deep freeze: A virtual shutdown in all debt markets except U.S. Treasuries. An avalanche of selling — and virtually no buyers — for corporate bonds, commercial paper, asset-backed securities, municipal bonds and all forms of bank loans.

e.g.: Pink-slip plague Mass unemployment --- about 500,000 Americans being laid off PER WEEK in 2009. In the third week of February, 667,000 families lost their paychecks — 36,000 more than the week before and the biggest surge since 1982. More than 5.1 million Americans are now on unemployment — an all-time record high. For more information go to: US unemployment

e.g.: Government bond collapse: A steep decline in the price of medium-and long-term government securities, as the U.S. Treasury bids aggressively for scarce funds to finance a ballooning budget deficit.

This list does not include the thousands of small companies in serious trouble. And don't forget the broken health care system, the fractured school system and collapsing social security system!

In summary: The economic system is broken and it is not being fixed because we do not have the political will to do so! Corporate influence is stronger than the will of the people! It does not appear that the federal government is able to stop the economic meltdown! We and the world are in a real economic depression!

ALERT: Your feedback on this article is most appreciated. Thank you: E-mail author

References:

Abuse of credit: what is this, anyway?

Traditional banking rules enforced by a central government which wishes to avoid massive lending bubbles/panics/depressions, the dreaded BPDs, sets rules for banks. One of the most useful rules is the one that prevents lending/holding ratios from dropping below a sensible limit. Banks have to attract some savings in order to lend. Now, in good times with stability and no bubbles, they are permitted to lend at a 10:1 ratio. Ten dollars can be lent on one dollar of savings. This rationalization of money via lending works in normal times. But when banks or QUASI banks such as investment/finance houses are allowed to do what Bear Stearns just did---lending on a 90-1 dollar ratio, it doesn't take much to trigger a complete collapse in any small downturn.

Andrews Ken, “Secured Mortgage Lending explained,” February 18, 2007. Lending explained

Attwood, Mathew, “Which credits are covered by the CDS market?” Credit, April, 2008. Website

Balber Carmen, "One decade, $5 Billion, bought Wall Street freedom from oversight," Consumer Watcgdog, March 06, 2009. causes of meltdown

Bank Capital Requirement: Bank regulations require that a bank have a specific amount of cash as liquidity to cover bank obligations. The capital requirement is a capital ratio , or the percentage of a bank's capital to its risk-weighted assets.

To be adequately capitalized under federal bank regulatory agency definitions, a bank holding company must have a Tier 1 capital ratio of at least 4%, a combined Tier 1 and Tier 2 capital ratio of at least 8%, and a leverage ratio of at least 4%, and not be subject to a directive, order, or written agreement to meet and maintain specific capital levels. To be well-capitalized under federal bank regulatory agency definitions, a bank holding company must have a Tier 1 capital ratio of at least 6%, a combined Tier 1 and Tier 2 capital ratio of at least 10%, and a leverage ratio of at least 5%, and not be subject to a directive, order, or written agreement to meet and maintain specific capital levels. A 10 % capitalization has been a general requirement.

Bond: is a loan; the issuer is the borrower, the bond holder is the lender, and the coupon is the interest. It is a formal contract to repay borrowed money with interest at fixed intervals. what is a bond

Briefing, “ What went wrong, “The Economist, March 19, 2008. [ shadow banking system ] Website

Brock James W.. “The real issue behind saving Bear Stearns: size,” The Christian Science Monitor, April 7, 2008. Financial terrorism

_____, “Concerns rise of US bank failure,” The Sidney Morning Herald, March 7, 2008 credit rating

Dauenhauser Scott, "MBS, CDO's and CDS in Layman's Terms," The meridian, September 29, 2008. CDOs & CDS relationship

Example: Pretend that you have a mortgage (okay, most of us aren't pretending) and you make principal and interest payments each month - these payments are made to your loan servicer and then split up as follows:

Deeter Karl, Missed mortgage payment? Bad debt? How a bad debt caused a crisis,” March 11, 2008. bad debt caused a crisis

Editorial, “Facing up to debt contagion “ Wall Street Journal, March 17, 2008 Website

Enron is a classic and famous example of a CDS gone wrong:

Envon used CDS as a scheme to finance itself. In 1999, Citigroup had a huge exposure, almost $1.7 billion, to Enron. This amount was four times the bank’s internal limit on such an exposure, so Citigroup used the CDS mechanism to spread their risk. In a deal known as Yosemite, the bank underwrote and sold their Enron corporate bonds as “senior unsecured notes.” Enron stayed in business as long as it could generator investors to provide cash.

The financial problems at Enron spread to not just its subsidiaries but to all those who purchased CDS and similar derivative instruments. Two firms of Enron, water specialist Azurix, doing business in Argentina, and the Dabhol Power Company of India had financial problems and went bust. These subsidiaries, part of a network of more than 3,000 firms linked to Enron, were claimed by the company to be 'unconsolidated affiliates', which do not have to be shown on balance sheets. Enron was “ cooking “ its accounting books to make itself look good and no one monitored these accounting procedures. Indeed, the respectable accounting firm, Arthur Anderson, did the cooking [questionable accounting that kept hundreds of millions of dollars in debt off its books and employees had illegally destroyed thousands of documents and computer records relating to Enron. ] Website 1 Website 2

The Enron effect affected everyone world-wide who bought and traded CDS.

Website

It affected Argentina, England, France, Germany and China. An international example of the impact of Enron impact: J.P. Morgan sold Argentina default swap insurance purchased from Daehan Investment Trust and Securities, a Korean bank. as a way of restructuring its banking system.

Website

The tragedy of Enron is that governments and banking institutions did absolutely nothing to stop the tragedy from reoccurring. The Enron tragedy resurfaced again in 2008.

Evans, David, “The poison in your pension,” Bloomberg Magazine, July, 2007. Pension poison

Ferguson James “Credit default swaps: How to spot riskiest banks,” MoneyWeek, 03/17/2008. Website

Gaffen David, “Worry Seeps Into Financials (Again),” Wall Street Journal, April 10, 2008 Website

Gagliano Rico & Hatley Mike, “Financial Crisis 101: CDOs explained,” Market Place, October 03, 2008. Financial Crisis 101: CDOs explained

Goodspeed Ingrid, "Overview of the sub-prime market meltdown," Overview of prime-sub meltsown

Hedge funds, wikipedia. Hedge fund info

Sociologist, author, and financial journalist Alfred

W. Jones is credited with the creation of the first hedge fund in

1949. [ Steve Eisen took this instrument to a another level about

2005 ]

_____, "House of Cards - 'Origins of the Financial Crisis' Then and Now,'' Slideshow. House

of Cards: Origins of crisis Slideshow

Kyle Bass was convinced the booming housing market was really one big house of cards and began to find ways to profit from it. He invested in "credit protection," a kind of insurance on various mortgage-backed securities. As those securities declined in value, his insurance paid off. Kyle Bass' hedge fund made more than a billion dollars in profit.

Hull, John, et la, “The relationship between credit default swap spreads, bond yields, and credit rating announcements, “ University of Toronto, January, 2004. Website

International Swaps and Derivatives Association, Inc., “Contract CDS Syndicated-Secured-Loan CDS-Standard Terms Supplement,” May 22, 2007. website

Jacoby James and Jill Landes, "House of Crisis 2009," CNBC, February 13, 2009. webvideo

Jung, Alexander and Pauly, Christoph, “Iceland's

Credit Crunch Blues,” Business Week, April 11, 2008,

Website

Lewis Michael,"The End," Portfolio.com, December 2008 Issue. Eisen hedge funds & end of housing boom | 'Lewis saw it coming' in The Motley Fool

Longstaff, Francis, et la, "The Credit Default Swap market,” UBC Seminar, October 24, 2003. Website

Market size for CDS: The market for the credit default swaps has been enormous. Since 2000, it has ballooned from $900 billion to more than $45.5 trillion — roughly twice the size of the entire United States stock market. Also in sharp contrast to traditional insurance, the swaps are totally unregulated. Cyclic Economist March 07, 2009 [ The New Yourk Tmes October 26th, 2008]

Martin Eric, “U.S. Stocks Fall on Profit

Concern; “ Bloomberg, Apr 08_08:

Website

Mason, Joseph R., and Rosner, Joshua, “Non-Ratings cause mortgage backed securities and collateralized debt

obligation market disruptions, “ May 2007.

Mayerowitz

Scott, “ECON 101: Credit Crunch for Dummies,” ABC NEWS Business

Unit, March 20, 2008. [ A Step-by-Step Look at What Caused the

Nation's Economic Troubles ]

Credit Crunch for Dummies

Momura, "CDOs in Plain

English, " Nomura Fixed Income Research, September 13, 2004. Nomura

Securities International, Inc.,Two World Financial Center Building

B New York, NY 10281-1198.

Moody loan ratings fiasco:

Bajaj Vikas, "Security ratings rules breached, Moody's admits"

International Herald tribune, July 1, 2008

Moody loan ratings fiasco

Morgensen, Gretchen, “Arcane Market is next to face big credit test,” New York Tines, February 17, 2008. Website 1 Website 2

Morrissey Janet, “Credit Default Swaps: The Next Crisis?” Time, March 17, 2008. Credit Default Swaps

Moses Abigail and Harrington Shannon D., “Company Bond Risk Rises on Emergency Fed Cut, Bear Stearns Sale,” March 17, 2008 Website

Newman, Rich, “A beginner’s Guide to Credit Default Swaps,” December 09, 2007. website

Neidenberg Milt, “What lurks behind Bear Stearns bailout? “Worker’s World, April 10, 2008. Website

Nolan Gavin, “Back to basics “ Credit, December, 2007. Website

Partnoy, Frank and Skeel, David A., “The

Promise and Perils of Credit Derivatives,”

Pittman Mark,

"God I Hope You're Wrong' Wall Street, "Bloomberg magazine,

December 19, 2007.

Hedge fund & Bass prediction of housing bubble

Bass conceived a hedge fund that bet on a crash for residential real estate by trading securities based on subprime mortgages to the least credit-worthy borrowers. The investment bank, which Bass declines to identify, owned billions of dollars in mortgage-backed securities.

"Interesting presentation," Bass says the firm's chief risk officer said into his ear, his arm draped across Bass's shoulders. ``God, I hope you're wrong.'' Within six months, Bass was right. Delinquencies of home loans made to people with poor credit reached record levels, and prices for the securities backed by these subprime mortgages plunged.

Pearlstein Steven, a Washington Post business columnist, was honored with the Pulitzer Prize recently for commentary for his columns about mounting problems in the financial markets. Pearlstein was online Wednesday, April 2, at 11 a.m. ET to discuss financial regulation reform and lessons from the current crisis. “ Thoiry, France: I have, in an amateur manner, tried to explain to my wife the basic principles of the $45 trillion credit defaults swaps market: Imagine that instead of going to a regulated insurance company we insure our house with a neighbor. We do this without knowing if our neighbor has sufficient funds to pay us if our house burns down. Our neighbor goes down to the local bar and (without telling us) sells the insurance contract to a stranger without making sure that he has funds to cover a fire in our house. Ten other people in the bar decide to get in on the action and sell and buy among themselves five contracts insuring our house against fire (i.e. making bets that our house will or will not burn down). In the end there are six insurance contracts on our house between people who do not know each other and who may or may not have funds to cover a fire. Imagine the mess if the house burns down...My wife does not believe that anyone would be this stupid. I claim that there are thousands of investment bankers and hedge fund managers with million dollar bonuses who are in fact this stupid. Is this correct? And what will happen when companies start to "burn down" in the coming recession?

Example of CDS by Steven Pearlstein: You have it precisely correct. I am laughing out loud at reading your comment because I tried to do the same thing with my wife, using the same analogy, and she looked at me as if I was nuts. But it is important for everyone to understand this market, because it is a good metaphor for how we've run off the track. What started out as a legitimate hedging instrument, perhaps, has now morphed into an instrument not only of speculation but unfetterd market manipulation (SEC, please note). Moreover, what you didn't explain to your wife is that these insurance contracts are then bought and sold on secondary markets using large amounts of debt--debt that in many cases is given by the very banks whose "house" was being insured. So you get investors who may be doubling down on their insurance bets by borrowing from the same banks, or from hedge funds that have borrowed from the same bank. That's why this is so complex, why it is so intertwined, and why nobody knows what would happen if one major institution fails, although we can surmise that the ripple effects would be significant and difficult to know in advance. “ Website

Pittman, Mark, Katz Alan and David Mildenberg, “Citigroup, Wells Fargo May Loan Less After Downgrades (Update3),“ Bloomberg, April 8, 2008. Website

Ponzi scheme:

"is a form of pyramid scheme in which new investors must continually be sucked in at the bottom to support the investors at the top. In this case, new borrowers must continually be sucked in to support the creditors at the top. The Wall Street Ponzi scheme is built on “fractional reserve” lending, which allows banks to create “credit” (or “debt”) with accounting entries. Banks are now allowed to lend from 10 to 30 times their “reserves,” essentially counterfeiting the money they lend. Over 97 percent of the U.S. money supply (M3) has been created by banks in this way.2 The problem is that banks create only the principal and not the interest necessary to pay back their loans, so new borrowers must continually be found to take out new loans just to create enough “money” (or “credit”) to service the old loans composing the money supply. The scramble to find new debtors has now gone on for over 300 years - ever since the founding of the Bank of England in 1694 – until the whole world has become mired in debt to the bankers' private money monopoly. The Ponzi scheme has finally reached its mathematical limits: we are “all borrowed up.”

Rating: In the USA there are seven credit rating institutions. For example, Moody's assigns bond credit ratings of Aaa, Aa, A, Baa, Ba, B, Caa, Ca, C, . Standard & Poor's and Fitch assign bond credit ratings of AAA, AA, A, BBB, BB, B, CCC, CC, C, D. credit rating

Schwartz, Nelson D. And Creswell, Julie, “What Created This Monster? “ New York Times, March 23, 2008 Website

Schwartz, Robert F., “RISK DISTRIBUTION IN THE CAPITAL MARKETS: CREDIT DEFAULT SWAPS, INSURANCE AND A THEORY OF DEMARCATION. “ Fordham Journal of Corporate & Financial Law, 2007, Website

Sharon Bill, “The Federal Reserve - isn’t, “ Between the Cracks, March 31st, 2008. Website

Shedlock, Mish, “Mishs Togele Bonds – Yet Another High Wire Act,” Global Economic Trend Analysis, June 25, 2007 worst depression

Sub-prime: From 2003 to 2006, new issues of CDOs backed by asset-backed and mortgage-backed securities had increasing exposure to subprime mortgage bonds. These were mortgages issued to home-buyers who bought with no down payment.

Supkis Elaine Meinel, “Bank Rescues Means Exact Replication Of Great Depression,” EZ Reading Money Matters, March 21, 2008. Bank rescue & bad depression

Swaps concept: This is similar to the old fashioned bargaining. Swapping is exchanging one item or commodity for another of equal value. For example:

Sykes Timothy,"Who Is Steve Eisman?" Trade Monster, November 07, 2008. Teather, David,"The woman who built financial 'weapon of mass destruction,'" The Guardian, September 20, 2008. Blythe Masters of JP Morgan maker of CDS

Toxic Debt:

refers to the illiquid mortgage assets that have lost value as the housing correction has proceeded. While the underpinnings for these toxic assets is home mortgages (both sub prime and not), they have been broken down into various instruments which include Mortgage Backed Securities, Collateralized Debt Obligations (CDO's), Equity Tranches, Credit Default Swaps, Structured Investmet Vehicles (SIV's), and who knows what else. These derivatives are less regulated than many investments and their value is much harder to quantify. Toxic debt

Tranche:

In structured finance, a tranche (misspelled as traunch or traunche) is one of a number of related securities offered as part of the same transaction. The word tranche is French for slice, section, series, or portion. In the financial sense of the word, each bond is a different slice of the deal's risk. Transaction documentation (see indenture) usually defines the tranches as different "classes" of notes, each identified by letter (e.g. the Class A, Class B, Class C securities). The term "tranche" is used in fields of finance other than structured finance (such as in straight lending, where "multi-tranche loans" are commonplace), but the term's use in structured finance may be singled out as particularly important. Use of "tranche" as a verb is limited almost exclusively to this field. [ Wikipedia] Example: A bank transfers risk in its loan portfolio by entering into a default swap with a "ring-fenced" SPV ("Special Purpose Vehicle"):

The SPV buys gilts (UK government bonds)

The SPV sells 4 tranches of credit linked notes with a waterfall structure whereby:

Tranche A absorbs the first 25% of losses on the portfolio

Tranche B absorbs the next 25% of losses

Tranche C the next 25%

Tranche D the final 25%

Tranches B, C and D are sold to outside investors

Tranche A is bought by the bank itself

Source: _____, “Understanding CDO, CDS and the American's Crash of 2008,” Understanding CDO, CDS

Bankers created an even newer product call the Credit Default Swap or CDS using the money from CDO as the collateral for the CDS, it guaranteed the reimbursement of the investors if the hedge fund ever incurred any lost. With$ 5 billion in CDO, they obtained $50 billion funds by floating CDS in the market at a hire rate of return.

This time around, the market went into a frenzy for the well secured and high return CDS. Their investors would included, insurance companies, retirement funds, educational endowment funds, personal investment plans, foreign governments, etc. As the demands swamped in, the issuance of CDS increased many folds and, thus, got many from many countries into this “money paper” game. Soon the size of CDS reached $500billion while its collateral still remained at $5 billion, unchanged. Then came year 2006, as the housing began is decline from its peak, this money “food chain” began to break up as housing price along with housing demands began to fall. As the economic slowed down, the mortgage borer had to give up their houses, this time, the foreclosed houses’ value is substantially lower than the outstanding mortgage loans. So, the value of the collaterals for the CDO declined. As the CDO borrower failed, the CDS market is badly shaken. Thus, all the major banks and sovereign funds of the world began reporting huge losses.

Underwriters for CDO:

According to Thomson Financial, the top underwriters before September 2008 were Bear Stearns, Merrill Lynch, Wachovia, Citigroup, Deutsche Bank, and Bank of America Securities. CDOs are more profitable for underwriters than conventional bond underwriting due to the complexity involved. The underwriter is paid a fee when the CDO is issued. The high-risk nature of all asset backed securities caused most of these firms to enter bankruptcy or be bailed out by the taxpayer in 2008 when the risks were properly understood and the value of all tranches collapsed. Underwriters

____, “ UPDATE 3-Financial swaps weaken on credit exposures,” Reuters, March 4, 2008. Website

___ WaMu's credit protection costs fall 19

pct-Markit,” Reuters, Apr 7, 2008

Website

Weissman Robert and Donahue James, “Wall

Street’s Best Investment: Ten Deregulatory Steps to Financial

Meltdown,” Multinational Monitor, March, 2009.

Their ten steps: [ as in Balber ] The Repeal of Glass-Steagall and the Rise of the Culture of:

Recklessness

Hiding Liabilities: Off-Balance Sheet Accounting

The Executive Branch Rejects Financial Derivative Regulation

Congress Blocks Financial Derivative Regulation

The SEC’s Voluntary Regulation Regime

No Predatory Lending Enforcement

Federal Preemption of State Regulation and Consumer Protection Laws

Escaping Accountability: Assignee Liability

Merger Mania

Rampant Conflicts of Interest: Credit Ratings Firms’ Failure

Wikipedia Encyclopedia, “Credit Default Swaps. “ Website

Wikopedia, “Federal Deposit Insurance Corporation.“ Website

Zabel, Richard (2008-09). "Credit Default Swaps: From Protection To Speculation". Robins, Kaplan, Miller & Ciresi L.L.P. Protection to speculation